v-g.site News

News

Student Loan Refinance Requirements

Student loan amount: $36, (the average federal student loan debt per borrower) · Months remaining in repayment: months, or 10 years · Interest rate: %. You're paying high interest rates on your student loans. · You have multiple federal or private student loan payments to make each month. · You have a good credit. Compare student loan refinancing rates from up to 7 lenders without affecting your credit score for free! Rates range from % to % APR. Close with a. NOTE: Borrowers who refinance federal student loans with a private loan could lose certain benefits or repayment options, such as income-based repayment plans. Eligibility Requirements for Refinancing Both private and federal student loan holders can be eligible for refinancing. However, student loan refinancing. Variable rates from % – % APR (with AutoPay). Rate is variable and subject to change. Interest rates on variable rate loans are capped at %. Lowest. Variable rates range from % APR to % APR with a % autopay discount. Unless required to be lower to comply with applicable law, Variable Interest. While refinancing your federal student loans into a private student loan can sometimes lower your interest rate, your private student loan will not necessarily. We offer fixed interest rates, which have an interest rate and payment amount that remains the same over the term of the loan. Rates range from % to %. Student loan amount: $36, (the average federal student loan debt per borrower) · Months remaining in repayment: months, or 10 years · Interest rate: %. You're paying high interest rates on your student loans. · You have multiple federal or private student loan payments to make each month. · You have a good credit. Compare student loan refinancing rates from up to 7 lenders without affecting your credit score for free! Rates range from % to % APR. Close with a. NOTE: Borrowers who refinance federal student loans with a private loan could lose certain benefits or repayment options, such as income-based repayment plans. Eligibility Requirements for Refinancing Both private and federal student loan holders can be eligible for refinancing. However, student loan refinancing. Variable rates from % – % APR (with AutoPay). Rate is variable and subject to change. Interest rates on variable rate loans are capped at %. Lowest. Variable rates range from % APR to % APR with a % autopay discount. Unless required to be lower to comply with applicable law, Variable Interest. While refinancing your federal student loans into a private student loan can sometimes lower your interest rate, your private student loan will not necessarily. We offer fixed interest rates, which have an interest rate and payment amount that remains the same over the term of the loan. Rates range from % to %.

Do you have federal and private, only private, or only federal student loans? · Who is your loan servicer? · Are your current interest rates fixed or variable? What you need to qualify for student loan refinancing · Good credit history: In general, private lenders will require you to have a FICO score in the high s. Take control of your student loan debt · Rates as low as % APR* (View rates) · Fixed-rate and variable-rate options · Refinancing loans from $5, to $75, Who Can Apply for Refinance Rates? · Degree: Many lenders offer student loan refinancing only to graduates. · Income: Lenders typically want to see evidence of a. The best time to apply for student loan refinancing, is when you are in better financial standing than you were when you originally took out the loan for your. How to know if refinancing your student loan is a good idea · You have at least three months' expenses in the bank (emergency fund). · Your debt-to-income ratio. Fixed rates Rates1 starting at %; As low as % APR 5, 10, and 15 year term options available · Loans starting at $5,, and up to $, · %. The lowest federal and private student loan refinance rates are around % in terms of variable rates and % for loans with fixed rates. Can't qualify for. Should I refinance my student loans? · Refinance one loan or multiple loans (minimum of $5, total). · Get a fixed or variable rate with a term of 5, 7, 10, or. You may need a credit score that's at least in the mids. Most borrowers who refinance have been out of school for a bit and built up their credit, which. Through our lenders you'll be able to refinance student loans, both federal and private, including graduate loans, into one convenient loan at a great rate. To qualify for refinancing or student loan consolidation through Education Loan Finance, you must have at least $10, in qualified student loan debt and must. $5, is the minimum requirement to refinance. The maximum loan amount is $, for those with medical, dental, pharmacy or veterinary doctorate degrees. EdvestinU Refinance Loan · Fixed Rates. % – % APRw/ optional% automatic debit discount · Variable Rates % – % APRw/ optional%. You answer a few quick questions to request your personalized refi rates. We present you with different offers based on your eligibility, including new. Credit score: Lenders use your credit score and history to set interest rates. The better your credit, the more likely a lender is willing to refinance your. Rates Starting at % APR1. Nationally Recognized as One of the Best Education Loans. RISLA offers nationwide refinancing options with low fixed interest. With A Credit Union · Simplify When You Refi · Competitive Rates · Flexible Terms · Personal Support · Real borrower stories · % · %. With A Credit Union · Simplify When You Refi · Competitive Rates · Flexible Terms · Personal Support · Real borrower stories · % · %. Splash marketplace loans offer fixed rates between % APR to % APR (without autopay) and terms of 2 to 7 years. Personal loans offered through the.

Maximum Long Term Capital Gains Tax

Short-term capital gain: 15 (if securities transaction tax paid on sale of equity shares/ units of equity oriented funds/ units of business trust) or normal. Short term gains on stock investments are taxed at your regular tax rate; long term gains are taxed at 15% for most tax brackets, and zero for the lowest two. Short-term capital gains are taxed at the same rate as your ordinary income. Meanwhile, long-term gains are taxed at either 0%, 15%, or 20%. The rate you pay is. The term "net capital gain" means the amount by which your net long–term capital gain for the year is more than your net short–term capital loss. The highest. Capital gains from tangible assets, such as fine art, antiques, coins and valuable wine, are typically taxed at a maximum 28% tax rate regardless of how long. Long-term capital gains on investments held for more than a year are taxed at the rate of 0%, 15% or 20%, depending on your taxable income and tax filing status. Short-term capital gains are gains that apply to assets or property you held for one year or less. They are subject to ordinary income tax rates meaning they're. That figure would be taxed at 22%. The remaining $4, of the gain, however, would be taxed at 24%, the rate for the next highest tax bracket. If you have a taxable capital gain, you may be required to make estimated tax payments. Refer to IRS Publication , Tax Withholding and Estimated Tax, for. Short-term capital gain: 15 (if securities transaction tax paid on sale of equity shares/ units of equity oriented funds/ units of business trust) or normal. Short term gains on stock investments are taxed at your regular tax rate; long term gains are taxed at 15% for most tax brackets, and zero for the lowest two. Short-term capital gains are taxed at the same rate as your ordinary income. Meanwhile, long-term gains are taxed at either 0%, 15%, or 20%. The rate you pay is. The term "net capital gain" means the amount by which your net long–term capital gain for the year is more than your net short–term capital loss. The highest. Capital gains from tangible assets, such as fine art, antiques, coins and valuable wine, are typically taxed at a maximum 28% tax rate regardless of how long. Long-term capital gains on investments held for more than a year are taxed at the rate of 0%, 15% or 20%, depending on your taxable income and tax filing status. Short-term capital gains are gains that apply to assets or property you held for one year or less. They are subject to ordinary income tax rates meaning they're. That figure would be taxed at 22%. The remaining $4, of the gain, however, would be taxed at 24%, the rate for the next highest tax bracket. If you have a taxable capital gain, you may be required to make estimated tax payments. Refer to IRS Publication , Tax Withholding and Estimated Tax, for.

The maximum capital gains tax rate for individuals and corporations · – (· % · %. asset's tax basis is either a capital gain or a loss. Four maximum federal income tax rates apply to most types of net long-term capital gains income in tax. The maximum federal capital gains tax rate is 37%. When do you have to pay taxes on your stock market profits? Tax filers must pay stock market profits when. They're usually taxed at lower long-term capital gains tax rates (0%, 15%, or 20%). Capital gains from stock sales are usually shown on the B. Gains from the sale of collectibles, such as art, antiques, coins, and precious metals, are subject to a higher long-term capital gains tax rate of 28%. Whereas. The taxpayer deducts $2, of the long-term capital loss against the $6, dividend income, resulting in Part A taxable income of $4, which is taxed at the. The maximum long-term capital gains and ordinary income tax rates were equal in through Since , qualified dividends have also been taxed at the. While the federal long-term capital gains tax applies to all states, there are eight states that do not assess a long-term capital gains tax. They are. They're subject to a 0%, 15%, or 20% tax rate, depending on your level of taxable income. Short-term capital gains are gains on investments you owned 1 year or. Short-term capital gains are taxed at the investor's ordinary income tax rate and are defined as investments held for a year or less before being sold. Long-. Long-term capital gains taxes occur when an asset has been sold after being owned for over a year. These taxes can have rates of 0%, 15% or 20% depending on. That figure would be taxed at 22%. The remaining $4, of the gain, however, would be taxed at 24%, the rate for the next highest tax bracket. Yes, this means that you can pay as little as 0% in federal income taxes on your gains when you sell a long term asset. To determine if the capital gain is. Do I have to file a tax return if I don't owe capital gains tax? No. You are not required to file a capital gains tax return if your net long-term capital. Although capital gains taxes typically apply to the returns from any capital asset, including housing, U.S. homeowners benefit from a generous exemption for. Other sold assets will be taxed at long-term capital gains rates. The Federal rates are 0%, 15%, or 20%, depending on filing status and taxable income. Each. Net capital gain is the excess of net long-term capital gain minus net short-term capital loss. After , the capital gains tax rates on net capital gain. Long-term capital gains tax is lower than ordinary income tax. · You must own the asset for over one year to qualify for a long-term gain. · Tax rates for long-. The Percentage Exclusion for capital gains is capped at $, This means that any gain above $, will be taxed at standard income tax rates. The Flat.

Best Polo Shirt Brands

Polos & Polo Shirts for Men Since its introduction in , Ralph Lauren's men's polo shirt has become a lasting icon. Originally only. Retro Toffs create British made polo shirts in retro styles. Their high quality made in Britain polo's feature UK national teams for football and rugby. Women's Sport Cool DRI Polo Shirt, Moisture-Wicking Performance Polo Shirt for Women. Hanes · (20,) ; Women's Aero Uniform Polo Short Sleeve. AEROPOSTALE · (64). Men's Polo Shirts · Men's Ultra-Dry Anti-UV Stretch Jersey Golf Polo · Men's Ultralight Piqué Lacoste Movement Polo · Men's Regular Fit Ultra Dry Piqué Tennis Polo. We selected a polo shirt from five well-known brands including Sunspel, Ralph Lauren, Niccolò P., and Lacoste to compare each polo. Categories ; Custom Slim Fit Mesh Polo Shirt White · Add Polo Ralph Lauren - Custom Slim Fit Mesh Polo Shirt White to wishlist · (15). out of 5 stars. 1. Custom Under Armour Performance Polo Its only fitting that the custom Under Armour Custom Performance Polo Shirt would check in at the top of the list. One can select from the best collections from Fred Perry, Hackett London, Kenzo, Karl Lagerfeld, and Polo Ralph Lauren, each of whom has a different style and. You can choose from a broad portfolio of the most renowned polo shirt brands, such as men's polo shirts from Lacoste, GANT, Tommy Hilfiger, BOSS or OLYMP. Our. Polos & Polo Shirts for Men Since its introduction in , Ralph Lauren's men's polo shirt has become a lasting icon. Originally only. Retro Toffs create British made polo shirts in retro styles. Their high quality made in Britain polo's feature UK national teams for football and rugby. Women's Sport Cool DRI Polo Shirt, Moisture-Wicking Performance Polo Shirt for Women. Hanes · (20,) ; Women's Aero Uniform Polo Short Sleeve. AEROPOSTALE · (64). Men's Polo Shirts · Men's Ultra-Dry Anti-UV Stretch Jersey Golf Polo · Men's Ultralight Piqué Lacoste Movement Polo · Men's Regular Fit Ultra Dry Piqué Tennis Polo. We selected a polo shirt from five well-known brands including Sunspel, Ralph Lauren, Niccolò P., and Lacoste to compare each polo. Categories ; Custom Slim Fit Mesh Polo Shirt White · Add Polo Ralph Lauren - Custom Slim Fit Mesh Polo Shirt White to wishlist · (15). out of 5 stars. 1. Custom Under Armour Performance Polo Its only fitting that the custom Under Armour Custom Performance Polo Shirt would check in at the top of the list. One can select from the best collections from Fred Perry, Hackett London, Kenzo, Karl Lagerfeld, and Polo Ralph Lauren, each of whom has a different style and. You can choose from a broad portfolio of the most renowned polo shirt brands, such as men's polo shirts from Lacoste, GANT, Tommy Hilfiger, BOSS or OLYMP. Our.

We've worked hard to create the softest fabric on the planet. Our StratuSoft fiber blend combined with our proprietary softening process gives our men's polos. Polo is both a brand and a type of shirt. The brand "Polo" is associated with the clothing line created by Ralph. Top 7 Polo T-Shirt Manufacturers for Fashion Brands · 1. REISS – Best for High-End Brands · 2. Horsefeathers – Best for Innovation · 3. Hongyu Apparel – Best in. Polo RL and Brooks Brothers are my go-to's but for a good fit, quality and more affordable polo, Rountree & Yorke gold label by Dillard's. Top 8 High-Quality Polo Shirts Every Guy Should Wear · 1. Happier Performance Modal Polo – $79 · 2. We Will Live Performance Modal Polo – $79 · 3. Tidal Wave. The Best Polo Shirt Brands · Tailor Store · ASKET · Aurelien · Vilebrequin · Artknit Studios · Billy Reid · Wax London · The Resort Co. The Resort. Jerzees M Spotshield 50/50 Polo Shirt ; Some excellent color options and. by Randy O. · Some excellent color options and good quality. I would use, primarily. The most common would be Ralph Lauren without a doubt. The next most common would be Lacoste. One particular line of Polo t-shirts from Lacoste. Polo Ralph Lauren Piqué Stretch-cotton Polo Shirt - Blue - Xxl · Delivery: $ $ ; Psycho Bunny Kids Kayden Pique Polo BLACK / M/ · Delivery. Even the tiny Lacoste crocodile evolved in the early 21st Century, when it added the brand name to the logo. It's no wonder then that many men are happy to swap. Planet positive performance apparel inspired by nature and built to protect it. We make the best polos on the planet. Stylish and sustainable mens. Best Polo Shirt for Men Elevate your casual wardrobe with our collection of the best polo shirts for men at Brooks Brothers. Crafted from high-quality. Discover a stylish selection of polo shirts for men and women at Banana Republic. Shop now for classic designs and modern fits. Look your best with men's polo shirts from Bonobos. Shop for comfortable sweater polos, classic pique polos, performance polos and more men's polo shirts. Products · Adidas · B. Draddy · Callaway Golf · Charles River Apparel · Columbia · Eddie Bauer · Faherty Brand · Fairway & Greene. Best Polo Shirts · Edwards Snag Proof Long Sleeve Polo · Port & Company Men Tall Core Blend Jersey Knit Polo · Port & Company Men Core Blend Jersey Knit Polo · Port. Best Sellers · The Classics · Varsity Shop NEW · Back to the Routine NEW · James brand label that reads \"Psycho Bunny.\" Made from premium Pima cotton. Best Polo T-shirts for Men · Holderness & Bourne The Jenkins Shirt White & Thistle SS What are the best Italian polo shirt brands? The best designer polo shirts from Italy use Sea Island cotton and Egyptian Mako cotton. Boast is a registered trademark of Boast Brands Group LLC. Shirts. Shirts. Shop All · New Arrivals · Best Sellers · Final Sale · Best Sellers · Club Polo ·

Earn High Interest On Savings

How much of a difference does this make? If you deposit $50, into a traditional savings account with a %, you'll earn just $ in total interest after. Saving made easy. Earn high interest on every dollar without having it locked in for an extended period of time. There are no monthly fees and no minimum. The best high-yield savings account is UFB Portfolio Savings, earning the top rating of stars in our study. The account yields Up to % and doesn't. Grow your savings with an interest rate of % since August 01, Earn the same great rate on every dollar in your Account. Earn interest in either a registered or unregistered investment plan. Not sure? This account is offered exclusively through an ATB Wealth® advisor to help. A high-yield savings account offers much higher interest rates on your money than a traditional savings account – maybe more than 10 times more. Some high-yield. Maximize your savings with an American Express high yield savings account with Member FDIC & competitive interest rates offered in market. Yield Earned (APYE) or interest earned though interest is accruing. Interest Rates and APYs for all checking and savings accounts are variable and can be. Today's best high-yield savings account offer rates of 5% APY and above. See which banks are offering the highest rates today. How much of a difference does this make? If you deposit $50, into a traditional savings account with a %, you'll earn just $ in total interest after. Saving made easy. Earn high interest on every dollar without having it locked in for an extended period of time. There are no monthly fees and no minimum. The best high-yield savings account is UFB Portfolio Savings, earning the top rating of stars in our study. The account yields Up to % and doesn't. Grow your savings with an interest rate of % since August 01, Earn the same great rate on every dollar in your Account. Earn interest in either a registered or unregistered investment plan. Not sure? This account is offered exclusively through an ATB Wealth® advisor to help. A high-yield savings account offers much higher interest rates on your money than a traditional savings account – maybe more than 10 times more. Some high-yield. Maximize your savings with an American Express high yield savings account with Member FDIC & competitive interest rates offered in market. Yield Earned (APYE) or interest earned though interest is accruing. Interest Rates and APYs for all checking and savings accounts are variable and can be. Today's best high-yield savings account offer rates of 5% APY and above. See which banks are offering the highest rates today.

With an online high-yield savings account, you can reach your savings goals faster by earning interest at a higher rate than traditional savings accounts. Earn more interest with a high yield savings account · High-Rate Savings Account Features · Bank on your terms with Alliant's high interest online savings account. The interest you earn is based on your account balance and interest rate. You earn more interest if you start saving earlier and make regular deposits into your. Open a High Interest Savings Account with CI Direct Investing. Start saving by earning interest on every dollar with lower investment fees today. The best high-yield savings account rate from a nationally available institution is % APY, available from Poppy Bank. A multi-level savings program designed to provide high earning power with a competitive rate of return and access to funds anytime. The formula for calculating interest on a savings account is: Balance x Rate x Number of years = Simple interest. What's Compound Interest Compared With Simple. Explore the high interest and flexible savings account options from CWB to Our Flex Notice Account is a high-earning, low-maintenance option that. is safe and secure. Earn high interest on your savings. Get a competitive interest rate. Move money quickly and easily. Transfer funds online at no cost. A high-yield savings account (HYSA) is a savings account that pays a higher interest rate than traditional savings accounts. Here's what you should know. Above average interest rates: You'll typically earn significantly more than the national average for a standard savings account. · Flexibility: Your money isn't. Use our High Interest Savings account to earn up to % APY on balances up to $2, No matter which free savings account you choose, you'll enjoy the. Superior performance, serious savings · Earn % APY on all balances · No monthly maintenance fee · No minimum balance required · Interest compounded daily · FDIC-. High-yield savings accounts are a flexible and easy way to earn interest while saving money. They are perfect for short-term savings projects like creating. Our top picks for the best high-yield savings account rates are SoFi Bank (%), Bask Bank (%) and Discover Bank (%), but rates are as high as. Jumpstart™ High Interest Savings Promotion¹ · No monthly fee or minimum balance · Free online bill payments · For new personal deposits only · Limited time rate. High Interest Savings Account (HISA). Earn a bonus interest rate when you set aside funds for savings. Key features: Only pay for the transactions you make. Compounding is, essentially, earning interest on interest earned. As a savings account accrues interest, it gradually increases the total principal — increasing. Many banks now offer high-yield savings accounts with rates above %. That's far above the average rate of a traditional savings account: currently %.

Jobs Where You Make 100k A Year

Roofing Sales Trainee- Generate Leads and Conduct presentations and sell Roofing SOLAR SALES TRAINEE: • Lucrative Sales Opportunity • Earn $KK per year. I was making k briefly and it was making me fat and unhealthy. I also left that for a job slightly under at the guarantee I work no more than 40 hours a week. CDL A OTR Drivers - Earn Up to $k/yr - Weekly Pay! Position: CDL A Truck Drivers (Solo or Team Up to $, per year * Home Time: Every 2 weeks. $K Jobs Where Women Dominate · 1. Obstetrician/Gynecologist Median Annual Salary: $, Percent Female in Job: 65 Percent · 2. Nurse Anesthetist Median. v-g.site 【 Salary Converter 】 provides your hourly salary if you make $ per year. Use our tool to convert any salary in Annual / Monthly / Weekly. What you'd do: IT support specialists provide technical support and assistance for computer systems and networks. They troubleshoot issues, maintain hardware. From real estate broker and marketing manager to physician and chemical engineer, the world of jobs that pay $K is vast and varied. 3 After executives and qualified professionals, the highest paying jobs in the workforce - are sales jobs. 1, k $, jobs available on Indeed Apply to. Construction workers (Various jobs); Building contractors; HVAC technician; Traveling Industrial contractor (Various jobs); Automotive repair. Roofing Sales Trainee- Generate Leads and Conduct presentations and sell Roofing SOLAR SALES TRAINEE: • Lucrative Sales Opportunity • Earn $KK per year. I was making k briefly and it was making me fat and unhealthy. I also left that for a job slightly under at the guarantee I work no more than 40 hours a week. CDL A OTR Drivers - Earn Up to $k/yr - Weekly Pay! Position: CDL A Truck Drivers (Solo or Team Up to $, per year * Home Time: Every 2 weeks. $K Jobs Where Women Dominate · 1. Obstetrician/Gynecologist Median Annual Salary: $, Percent Female in Job: 65 Percent · 2. Nurse Anesthetist Median. v-g.site 【 Salary Converter 】 provides your hourly salary if you make $ per year. Use our tool to convert any salary in Annual / Monthly / Weekly. What you'd do: IT support specialists provide technical support and assistance for computer systems and networks. They troubleshoot issues, maintain hardware. From real estate broker and marketing manager to physician and chemical engineer, the world of jobs that pay $K is vast and varied. 3 After executives and qualified professionals, the highest paying jobs in the workforce - are sales jobs. 1, k $, jobs available on Indeed Apply to. Construction workers (Various jobs); Building contractors; HVAC technician; Traveling Industrial contractor (Various jobs); Automotive repair.

k A Year Jobs in Greater Phoenix Area (3 new) · We Have a $, Problem and Need to Solve It · Business Development Representative (Entry-Level). If you like watching Judge Judy or C-Span this job has your name written on it. You can work as a court reporter by transcribing speeches, court trials. GOBankingRates determined the exact salary you would need to earn to take home an annual pay of $, in each state after taxes. Click through to see the. These top-paying jobs in the Military require more specialized training in addition to normal service commitments. 25 Jobs That Pay $K a Year · 1. Orthodontist · 2. Physician · 3. Dentist · 4. IT Manager · 5. Finance Manager · 6. Marketing Manager · 7. Lawyer · 8. We've put together a list of animal-related jobs, including high-paying jobs working with animals, and the education requirements needed to kickstart each. So, what are some top-paying remote jobs? We've listed jobs that all have the potential to pay $,+ per year. We've consulted Payscale to find the salary. We've listed 26 different jobs from eight career categories that all have the potential to pay $K+ per year. Many jobs pay over $, a year in various fields. These jobs include doctors, lawyers, software engineers, business leaders, pharmacists, psychologists, IT. Base Pay of $50, plus uncapped commission (on-track earningcould put you over $k/year) Bonus Our success as a company isa result of the hard work and. Jobs that Pay k a Year Without a Degree · 1. Business Owner · 2. Real Estate Broker · 3. Sales Consultant · 4. Air Traffic Controller · 5. Virtual Assistant · 6. The top spot on this list is what we deem the easiest of the seven k a year jobs - the executive assistant! 1) Executive Assistant. If you're. From technical careers to jobs in the medical profession, we list the best 2 year degrees for landing high paying jobs below. And, they pay more than you. I make six figures without any OT or supplemental income/jobs. To maximize I can tell you it's relatively easy to make k per year without significant. On average, many construction managers, electricians, and welders earn more than $, per year. For the trades skills, there is no necessity for two years. We've listed 18 jobs that all have the potential to pay $K+ per year. We've consulted Payscale to find the salary range for each role. Convert your pay rate between hourly, weekly, monthly, and yearly using our salary calculator tool. Explore and apply for jobs hiring today! What you'd do: Overseeing the creative services of an organization, creative directors manage a team of artists and other creative professionals on projects. v-g.site 【 Salary Converter 】 provides your hourly salary if you make $ per year. Use our tool to convert any salary in Annual / Monthly / Weekly.

Tax Free Retirement Planning

A (b) plan (also called a tax-sheltered annuity or TSA plan) is a retirement plan offered by public schools and certain (c)(3) tax-exempt organizations. The Thrift Savings Plan (TSP) is a defined contribution retirement savings and investment plan that offers Federal employees the same type of savings and tax. If you're under 50, the annual limit is $6,5and $7, for If you're over 50, the limit is $7, You won't get a tax deduction with a Roth. Employees can elect to defer receiving a portion of their salary which is instead contributed on their behalf, before taxes, to the (k) plan. Sometimes the. Step 1: Start with your required minimum distributions (RMDs), if applicable · Step 2: Tap interest and dividends · Step 3: Cash out maturing bonds and CDs · Step. Our financial plans help clients increase their after-tax income, minimize or eliminate their Required Minimum Distributions (RMDs), and reduce or eliminate. Employer contributions are tax-deductible. · Assets in the plan grow tax-free. · Plan options are flexible. · Tax credits and other benefits for starting a plan. The other answers I've seen to this question sum it up well. You can invest in Roth IRA's which are tax free. The most anyone can contribute. Two of the most commonly-used tax-exempt accounts in the U.S. are the Roth IRA and Roth (k). Contribution limits for Roth IRAs and Roth (k)s are the same. A (b) plan (also called a tax-sheltered annuity or TSA plan) is a retirement plan offered by public schools and certain (c)(3) tax-exempt organizations. The Thrift Savings Plan (TSP) is a defined contribution retirement savings and investment plan that offers Federal employees the same type of savings and tax. If you're under 50, the annual limit is $6,5and $7, for If you're over 50, the limit is $7, You won't get a tax deduction with a Roth. Employees can elect to defer receiving a portion of their salary which is instead contributed on their behalf, before taxes, to the (k) plan. Sometimes the. Step 1: Start with your required minimum distributions (RMDs), if applicable · Step 2: Tap interest and dividends · Step 3: Cash out maturing bonds and CDs · Step. Our financial plans help clients increase their after-tax income, minimize or eliminate their Required Minimum Distributions (RMDs), and reduce or eliminate. Employer contributions are tax-deductible. · Assets in the plan grow tax-free. · Plan options are flexible. · Tax credits and other benefits for starting a plan. The other answers I've seen to this question sum it up well. You can invest in Roth IRA's which are tax free. The most anyone can contribute. Two of the most commonly-used tax-exempt accounts in the U.S. are the Roth IRA and Roth (k). Contribution limits for Roth IRAs and Roth (k)s are the same.

There are several ways to generate tax-free income in retirement and the sooner you start planning for tax-free income the more potential choices you'll have. What are some tax-saving moves to make before I am required to take distributions? · Converting taxable assets to a Roth IRA. · Selling investments that have. Retirement and pension benefits include most income that is reported on Form R for federal tax purposes. This includes defined benefit pensions, IRA. Roth IRAs are also subject to deposit limits, but your taxes are not deferred on the amount of your deposit. However, your withdrawals will not be taxed after. The (k) plan allows these contributions to grow tax-free until they're withdrawn at retirement. At retirement, distributions create a taxable gain, though. Tax Free Retirement will show you how to avoid 9 common Financial Landmines, teach you how to generate tax-free retirement income. What they are: Taxable accounts include bank savings accounts and personal investment accounts. Your contributions to these accounts are made after taxes, so. This lowers your taxable income for the current year, which can save you money now, but you'll have to pay the taxes when you take the money out in retirement. When employees retire, the amount they withdraw is subject to income tax. Plans have regulations on eligibility and withdrawls. Many employers “match” the. an Individual Retirement Account, (IRA) or a self-employed retirement plan;; a traditional IRA that has been converted to a Roth IRA;; the redemption of U.S. Part of a tax-smart game plan for retirement is to consider tax-free income strategies, which can be an important component of your overall retirement. Unlike tax-deferred accounts, contributions to Roth (k)s and Roth IRAs are made with after-tax dollars, so they won't reduce your current taxable income. But. Tax-free retirement planning is accomplished through an individualized road map that outlines which tax-free vehicles and strategies should be utilized to. medical and retiree health expenses on a tax-free basis. Essentially, an HSA Withdraw your taxable retirement plan money (such as your. (k) or. Roth IRAs are often considered the ideal legacy planning vehicle because they grow tax-free income throughout your lifetime that can be passed down to your. Social Security income is taxed at your ordinary income rate up to 85% of your benefits; the rest is tax-free. Long-term investment gains, including qualified. IRAs are another way to save for retirement while reducing your taxable income. Depending on your income, you may be able to deduct any IRA contributions on. What are some tax-saving moves to make before I am required to take distributions? · Converting taxable assets to a Roth IRA. · Selling investments that have. With tax-qualified retirement plans that provide tax-deferred accumulation, such as (k)s and traditional IRAs, the money you contribute is pretax, meaning it. (k)/(b) distributions If all contributions to your workplace retirement plan were made with pre-tax dollars (which is typically the case), the full.

Obtc Vs Gbtc

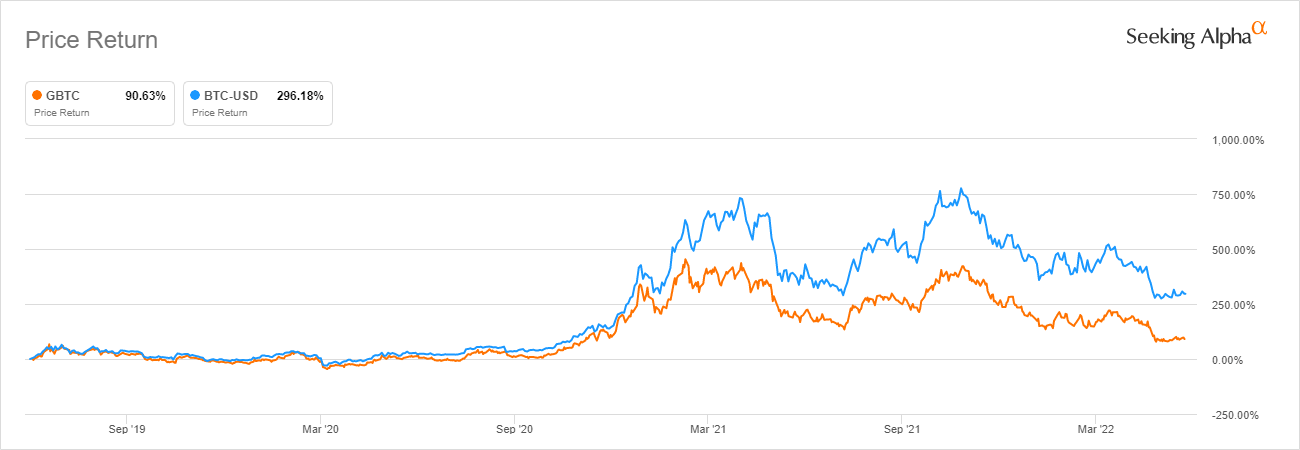

Comparison. Up to 50% OFF InvestingPro. Beat the market with premium AI GBTC , OBTC @ 4/30/21 Close! Reply. 1 0. Report. The Osprey trust has around $46 million in assets under management (AUM), far smaller than the Grayscale Bitcoin Trust's (GBTC) $ billion. Both funds. GBTC allows accredited investors to receive shares of the trust through private placement. Wealthy investors that put capital, either U.S. dollars or bitcoin. OSPREY FUNDS (OBTC). World Debt Governments Mt. Gox U.S. ETFs UTXOs Sets Addresses Sets Entities' Charts. Search In Table. OBTC continues to trade at a discount to NAV even though it has GBTC and ARKB. On the other hand, investment advisors leaned. William asks: I read your interview with Matt Hougan today (2/2/24) about BITW vs BITB. GBTC or OBTC. So the new bitcoin ETFs won't impress them – they'd have. GBTC or OBTC or RIOT. Header icon. GBTC vs OBTC vs RIOT Comparison. Open Charts GBTC Compare. GBTC vs OBTC vs RIOT Comparison Chart. 1D. 1W. 1M. 1Y. vs gold, or GBTC vs bitcoin). And be sure you're not violating your firm's GBTC, BITW, OBTC, etc.? Lars Larsen, ChFC®, President, Heritage. BITO vs GBTC Trade-offs · BITO doesn't invest directly in Bitcoin — it holds futures contracts. · Futures contracts are agreements to buy or sell the asset at a. Comparison. Up to 50% OFF InvestingPro. Beat the market with premium AI GBTC , OBTC @ 4/30/21 Close! Reply. 1 0. Report. The Osprey trust has around $46 million in assets under management (AUM), far smaller than the Grayscale Bitcoin Trust's (GBTC) $ billion. Both funds. GBTC allows accredited investors to receive shares of the trust through private placement. Wealthy investors that put capital, either U.S. dollars or bitcoin. OSPREY FUNDS (OBTC). World Debt Governments Mt. Gox U.S. ETFs UTXOs Sets Addresses Sets Entities' Charts. Search In Table. OBTC continues to trade at a discount to NAV even though it has GBTC and ARKB. On the other hand, investment advisors leaned. William asks: I read your interview with Matt Hougan today (2/2/24) about BITW vs BITB. GBTC or OBTC. So the new bitcoin ETFs won't impress them – they'd have. GBTC or OBTC or RIOT. Header icon. GBTC vs OBTC vs RIOT Comparison. Open Charts GBTC Compare. GBTC vs OBTC vs RIOT Comparison Chart. 1D. 1W. 1M. 1Y. vs gold, or GBTC vs bitcoin). And be sure you're not violating your firm's GBTC, BITW, OBTC, etc.? Lars Larsen, ChFC®, President, Heritage. BITO vs GBTC Trade-offs · BITO doesn't invest directly in Bitcoin — it holds futures contracts. · Futures contracts are agreements to buy or sell the asset at a.

Osprey Bitcoin Trust (OBTC). + (+%) USD | OTCM | Aug. Bitwise Bitcoin ETF (BITB) · Grayscale Ethereum Trust (ETH) (ETHE) · Osprey Bitcoin Trust (OBTC). NFTZ BTF ZCSH FDIG DAPP BCDF BITQ BTCR GLIV FILG LEGR ETCG DAM GBTC IBLC OBTC BIDS BITS SPBC BLCN XBTF HZEN ETHE STCE WGMI BITO BYTE RIGZ BKCH BLOK CRPT GFOF. GBTC %. Grayscale Filecoin Trust (FIL). $ FILG % OBTC. Osprey Bitcoin Trust. $ %. add_circle_outline. GBTC trades in OTC markets and is available through many brokerages and tax-advantaged accounts like individual retirement accounts (IRAs) and (k)s. It. CME Bitcoin Futures (/BTC); CME Micro Bitcoin Futures (/MBT) ; Grayscale Bitcoin Trust (GBTC); Osprey Bitcoin Trust (OBTC); Bitwise 10 Crypto Index Fund (BITW). eth fami fbtc fcel fundamental gann gas gbct gbgtc gbtc gbtclong gbtcpremium obtc oil oscillator prog pslv qld qlgn qqq rgs ride roku rut sbny sco sdow. Bitwise Bitcoin ETF (BITB) · Grayscale Ethereum Trust (ETH) (ETHE) · Osprey Bitcoin Trust (OBTC). Overview: The Grayscale Bitcoin Trust (GBTC) is a prominent player 20) Osprey Bitcoin Trust (OBTC). Fund Size: $ Billion. Managing. Should You Buy or Sell Osprey Bitcoin Trust Stock? Get The Latest OBTC Stock Analysis, Price Target, and Headlines at MarketBeat. Ticker symbols. Grayscale Bitcoin Trust, GBTC. Riot Blockchain, Inc. RIOT. MicroStrategy Incorporated, MSTR. Osprey Bitcoin Trust, OBTC. Marathon Digital. There are now two publicly traded trusts that offer investors a way into their stash of Bitcoin tokens, but Grayscale Bitcoin Trust (OTC:GBTC) and Osprey. Performance Overview: GBTC. View More. Trailing returns as of 8/23/ Crypto Mania Is Back—But It Looks Different Than in | Then vs. Now. Their first product OBTC is designed to compete with Greyscales GBTC as Osprey and many other race for SEC approval for a real Bitcoin ETF. King believes. Gemini sues ex-partner Genesis over $B of GBTC shares. August 30, | v-g.site Grayscale Bitcoin Trust (GBTC). August 18, | v-g.site Osprey. Bitcoin vs. Gold. Bitcoin Priced In Gold Oz link. OZ. Bitcoin Priced In GBTC - Grayscale. ,BTC (B). HODL - VanEck. 10,BTC (M). OBTC, Osprey Bitcoin, 18, , , IBIT, iShares Bitcoin Trust Hedge Funds vs. Mutual Funds · Index Funds vs. Mutual Funds · Mutual Funds vs. United StatesOBTC. Osprey Bitcoin Trust. $ %. K. Add To United StatesGBTC. Grayscale Bitcoin Trust ETF (BTC). M. United StatesBITB. Comparison. Up to 50% OFF InvestingPro. Beat the market with premium AI GBTC , OBTC @ 4/30/21 Close! Reply. 1 0. Report. GBTC, $35,M, —. ₿ ,? $14,M, $14,M, —, %, OBTC, $M, —. ₿ 2,? $M, $M, —, %, %. Update.

Best Course For Option Trading

Find 5 Top online Options Trading courses, certifications, trainings, programs & specialization at Shiksha Online. Compare best Options Trading courses. The Options Trading Course Level 2 by Piranha Profits® is designed for experienced traders who want to take their trading profits to a new high without. Learn how to trade options and improve your investments from top rated trading professionals with an options trading course offered on Udemy. Let's see if options tickle your fancy, shall we? View Options Course Before trading options, you should discuss with your broker whether trading options. Upcoming Live Classes · Options Trading Masterclass · Combo LIVE Classes (Pro Options Trading Strategies + Mastering Technical Analysis + Futures Trading) · LIVE. Learn the best option trading strategy online. This course provides an overview of various options strategies, both in the cash and derivatives market. All the credits goes to option trading only mentor prateek varshney which is an underrated youtuber. He teach his 5 unique strategy purely based. This module emphasises on the use of strategies by the Investors and Traders for hedging his/her position in the market. Best Option Trading Courses for Beginners ; Options Trading for Beginners · 13, learners · by Jyoti Budhia. Find 5 Top online Options Trading courses, certifications, trainings, programs & specialization at Shiksha Online. Compare best Options Trading courses. The Options Trading Course Level 2 by Piranha Profits® is designed for experienced traders who want to take their trading profits to a new high without. Learn how to trade options and improve your investments from top rated trading professionals with an options trading course offered on Udemy. Let's see if options tickle your fancy, shall we? View Options Course Before trading options, you should discuss with your broker whether trading options. Upcoming Live Classes · Options Trading Masterclass · Combo LIVE Classes (Pro Options Trading Strategies + Mastering Technical Analysis + Futures Trading) · LIVE. Learn the best option trading strategy online. This course provides an overview of various options strategies, both in the cash and derivatives market. All the credits goes to option trading only mentor prateek varshney which is an underrated youtuber. He teach his 5 unique strategy purely based. This module emphasises on the use of strategies by the Investors and Traders for hedging his/her position in the market. Best Option Trading Courses for Beginners ; Options Trading for Beginners · 13, learners · by Jyoti Budhia.

Master the basics of options trading and learn about the options foundations, trading setups and strategies, call and put options, and the psychology of. I have been, and will continue, to direct people towards OA as the #1 place to learn both Options Training, as well as a deeper understanding of the important. The Options Course Second Edition: High Profit & Low Stress Trading Methods (Wiley Trading) [Fontanills, George A.] on v-g.site Offering you comprehensive trader training in equities, options, and automated trading. trading, so that new traders are given their best chance to succeed. Our free courses include more than videos on options trading. Learn the basics of options and key terms, options pricing, multiple strategies for beginner. Impact · Develop options vocabulary and interpret option payoffs · Unlock options trading strategies and their uses · Identify and apply the determinants of option. Bullish Bears community is a great educational resource for all type of traders. The best learning experience for the best price. Their educational platform is. In this blog, we will explore some of the best option trading courses available in India, each offering unique insights and expertise. Get an intro to common options trading strategies, ideal market conditions for each, and how to set them up. We'll also show you what to look for when managing. Options Trading Courses and Certifications · Options Trading for Beginners - The Ultimate In-Depth Guide · Options Trading for Rookies: Advanced Iron Condor. GTF Options Course. This course is designed for those who want to trade options professionally, in this course you will get to know how options premium. % free options trading courses on-demand. Self-paced, guided learning paths that help you reach your goals and make smarter trades. Our trading professionals at the Trading Strategy Desk® will conduct a 4-week virtual classroom course with a small group of investors who are seeking to. Options Trading for Beginners (FREE COURSE) | Basic to Advance Options Trading Course · 12 Option Trading Mistakes to Avoid | Option Trading For. We at Traders Insight have put together this comprehensive options course so you can to learn how to supercharge your trading and learn how to make money. Welcome to Options Trading for Beginners on v-g.site, where you will gain a solid understanding of options trading. This comprehensive course is. How to trade Options. 10 videos ; Learn Options Strategies. 9 videos ; Practical Options Trading. 8 videos ; Be a better trader. 10 videos. Options Ironshell™ by Adam Khoo and Bang Pham Van is an options trading course that teaches basic options and hedging strategies for profit and protection. Free Options Trading Courses online · Trading For Beginners · Options Trading Essentials: The ULTIMATE Guides · Option Trading: The best option trading strategy.

Annual Fee For Delta Reserve Card

Quick Business Card Comparison ; $0 intro annual fee for the first year, then $ · Rates & Fees · See Benefits ; $ Rates & Fees. Enter Delta Sky Club® at no cost. Effective 2/1/25, Reserve Card Members will receive 15 Visits per year to the Delta Sky Club; to earn an unlimited number of. Reserve Card Annual Fee is Going up to $ News. Looks like they're adding a few benefits. $ resy credit ($20 / month) and a $10 / month. - Delta Platinum Amex Business, , points after spending $ in the first 6 months, $ annual fee. - Delta Gold Amex Business, 80, points after. It appears the annual fee for the gold card is increasing to $ and the platinum card to $ as well. The card also comes with a generous welcome bonus and earns 3 miles per $1 on Delta and purchases made directly with hotels, 2 miles per $1 at restaurants. Delta SkyMiles® American Express Cards · Delta SkyMiles® Gold American Express Card. EARN 40, BONUS MILES · DELTA SKYMILES® PLATINUM AMERICAN EXPRESS CARD. The Delta SkyMiles Reserve Card has an annual fee of $ (see rates and fees). If you get the Platinum Card® from American Express, you'll pay an annual. The Delta Reserve Credit Card's annual fee is $ – which is hundreds of dollars more than the average credit card's annual fee. This annual fee is on par with. Quick Business Card Comparison ; $0 intro annual fee for the first year, then $ · Rates & Fees · See Benefits ; $ Rates & Fees. Enter Delta Sky Club® at no cost. Effective 2/1/25, Reserve Card Members will receive 15 Visits per year to the Delta Sky Club; to earn an unlimited number of. Reserve Card Annual Fee is Going up to $ News. Looks like they're adding a few benefits. $ resy credit ($20 / month) and a $10 / month. - Delta Platinum Amex Business, , points after spending $ in the first 6 months, $ annual fee. - Delta Gold Amex Business, 80, points after. It appears the annual fee for the gold card is increasing to $ and the platinum card to $ as well. The card also comes with a generous welcome bonus and earns 3 miles per $1 on Delta and purchases made directly with hotels, 2 miles per $1 at restaurants. Delta SkyMiles® American Express Cards · Delta SkyMiles® Gold American Express Card. EARN 40, BONUS MILES · DELTA SKYMILES® PLATINUM AMERICAN EXPRESS CARD. The Delta SkyMiles Reserve Card has an annual fee of $ (see rates and fees). If you get the Platinum Card® from American Express, you'll pay an annual. The Delta Reserve Credit Card's annual fee is $ – which is hundreds of dollars more than the average credit card's annual fee. This annual fee is on par with.

Annual Fee $ ; Credit Needed Good / Excellent ; Card Brand American Express ; The Bottom Line · This is a rather pricey Amex card for those who want to rack up. Card basics ; Annual fee, $ (Terms apply) ; Intro bonus, Earn 60, bonus miles after spending $5, in purchases in the first 6 months ; Reward rate, 3X. The Delta SkyMiles® Reserve American Express Card bears a huge $ annual fee, making the card more expensive than many domestic round-trip flights with the. $0 Annual Fee. Rates & Fees. Delta fee, when charged to your Delta SkyMiles® Reserve Amex Card. Card Members. Your Delta Skymiles Reserve card must have been you paying the new $ fee. If your card hasn't renewed yet at that new fee, you can NOT fly. Delta SkyMiles® Reserve Business Card. Annual Fee: $¤. Earn 75, Bonus Rates & Fees · Business Platinum Card. Annual Fee: $¤. And cardholders can pay a per-visit fee of $39 per person, per location for Sky Club access when traveling on a Delta partner airline flight that is not. Earn 55, Bonus Miles after spending $4, in purchases on your new card in your first 6 months of card membership. Annual fee, $0 introductory annual fee. Enter Delta Sky Club® at no cost. Effective 2/1/25, Reserve Card Members Annual Fee $95; Credit Needed Excellent; Card Brand Visa®. Sign-Up Bonus Earn. Despite its hefty annual fee, this card offers a slew of benefits (that aren't all covered here) that might be worth considering for some frequent flyers. Cons · $ annual fee. · Poor rewards rate on non-Delta purchases. · Limited redemption options. The Delta Reserve card has a hefty $ annual fee. Is it worth it? Yes, but only if you fly Delta a lot and are a heavy spender: If you mainly just want. The Delta SkyMiles® Platinum American Express Card is a mid-tier card with expanded benefits. It has a slightly higher $ annual fee (see rates and fees), but. Eligible Card Members get 15% off when using miles to book Award Travel on Delta flights through v-g.site and the Fly Delta app. Discount not applicable to. The card has benefits. There is a $ annual fee. However, the card offers perks such as free access to Delta Sky Club Lounges and a 20% discount on eligible. This card requires a $ annual fee. The Delta SkyMiles® Reserve Business American Express Card does not accept balance transfers. Earning the welcome offer. If you're going all in for Delta, this is the best card to have. It has a high price tag, but the annual First Class companion certificate can easily offer. For the annual $ fee, you get several travel perks, such as checking your first bag for free and priority boarding. You can get a Companion Certificate on. Other Delta cards offer you a lot of the same benefits with a more reasonable annual fee than the $ on this one. Plus the huge spends needed to gain "status". The Delta Reserve card is the most expensive of American Express' Delta cards in the U.S., but it is also loaded with high-end perks. Sky Club access alone.

How To Use Stocks As Collateral

You can use your marketable securities, such as stocks, bonds and mutual funds, as collateral. And of course, we'll consider how it all fits into your overall. An extension of credit based on eligible securities you pledge as collateral from qualified Merrill brokerage accounts. apply to purpose loans, and not all. A collateralized or securities-based loan allows you to utilize securities, cash, and other assets in brokerage accounts as collateral to obtain variable or. Depending on the options strategy you use, we may hold stocks or cash as collateral to make sure you can cover the position in case of assignment. A margin loan is a loan from your brokerage account that uses your securities as collateral. However, a margin loan has different interest rates, borrowing. The Securities Based Lending offering is the ideal vehicle for getting quick access Assets as collateral. The following movable assets can be used as. You can use securities you own as collateral to borrow money on margin. Money borrowed on margin can be used for whatever purpose you like—from purchasing. This is a loan that uses stock you own as your collateral. That means you continue to get the benefits of dividends or stock splits while also getting to use. No set-up, non-use, or cancellation fees; Ability to borrow up to % of your eligible asset value, depending on the collateral type. These lines of credit. You can use your marketable securities, such as stocks, bonds and mutual funds, as collateral. And of course, we'll consider how it all fits into your overall. An extension of credit based on eligible securities you pledge as collateral from qualified Merrill brokerage accounts. apply to purpose loans, and not all. A collateralized or securities-based loan allows you to utilize securities, cash, and other assets in brokerage accounts as collateral to obtain variable or. Depending on the options strategy you use, we may hold stocks or cash as collateral to make sure you can cover the position in case of assignment. A margin loan is a loan from your brokerage account that uses your securities as collateral. However, a margin loan has different interest rates, borrowing. The Securities Based Lending offering is the ideal vehicle for getting quick access Assets as collateral. The following movable assets can be used as. You can use securities you own as collateral to borrow money on margin. Money borrowed on margin can be used for whatever purpose you like—from purchasing. This is a loan that uses stock you own as your collateral. That means you continue to get the benefits of dividends or stock splits while also getting to use. No set-up, non-use, or cancellation fees; Ability to borrow up to % of your eligible asset value, depending on the collateral type. These lines of credit.

If clients are unable to maintain minimum equity requirements, securities pledged as loan collateral may be sold without prior notice. Clients should understand. Stocks and bonds: These financial assets can be used as collateral for a loan, although the value of the stock or bond can fluctuate and affect. Borrowing on securities based lending products or margin accounts and using securities as collateral may involve a high degree of risk including unintended tax. In general, the Federal Reserve seeks to value securities collateral at a fair market value estimate. Securities are valued using prices supplied by the Federal. A margin account lets you leverage securities you already own as collateral for a loan. Keep in mind that these loans are interest-bearing. U.S. Government Securities deposited as Escrow Deposit Supporting Collateral have a zero haircut. Deposits in OCC/CME cross-margins accounts utilize. These loans are typically called margin loans. The investments in your account are used as collateral for the loan. You may use the money that you borrow for. Connect with a Fidelity representative. Have a conversation to review your options. · Pledge your assets as collateral. You can use any combination of eligible. Stock lending programs give you cash payments every time your shares are lent out, which you can reinvest, put toward diversification, or spend on other. The bank will put a hold on your collateral. While your investment account will continue to earn interest and dividends, you may not be able to withdrawal large. The term securities-based lending (SBL) refers to the practice of making loans using securities as collateral. Securities-based lending provides ready access. For more information on the use of collateral under the Payment System Risk Reserve Banks accept a wide range of securities as collateral. General. Using stock for collateral is not the wisest way to lend or borrow money. anybody is free to borrow money and use their own property as. For more information on the use of collateral under the Payment System Risk Reserve Banks accept a wide range of securities as collateral. General. How to use stocks and bonds as collateral for a loan DONE. Yes stocks listed on stock exchanges can be offered as collateral for loans. The stocks are valued and considered good for about 50 percent of. Securities-based lines of credit allow borrowers to access cash without liquidating their investment portfolios. The portfolio serves as collateral — qualified. When a loan account is created, attach a stock-type collateral record. Enter the number of shares the member holds of this stock, as well as an initial. Securities-based lending refers to the practice of using non-retirement, marketable securities such as stocks, bonds and mutual funds as collateral for a line. New securities aren't the only source of collateral. You can also often borrow against the marginable stocks, bonds, and mutual funds already in your account.