v-g.site Overview

Overview

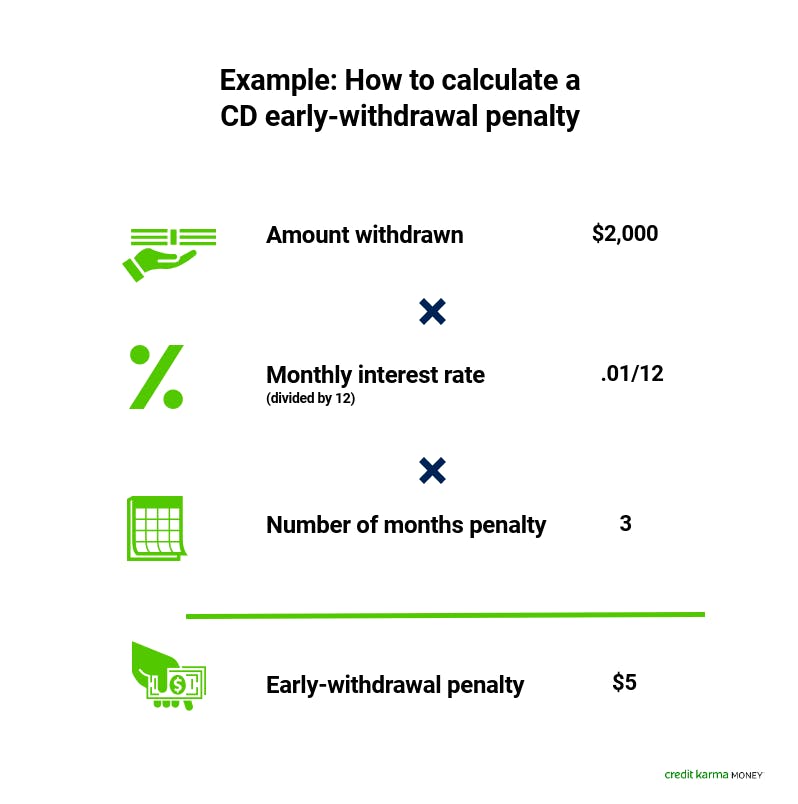

Penalty For Cashing Cd Early

A flat fee: Some banks have a minimum penalty amount (e.g., $25) if you withdraw early. An interest amount even if the interest hasn't yet been earned: This. Early withdrawal penalty: If you redeem a Certificate of Deposit (CD) prior to maturity, you will incur an early withdrawal penalty. For a CD with a twelve. I cashed my certificate of deposit (CD) before it matured, and the bank charged me an early withdrawal penalty. Can it do this? Yes. While there are some. Q: What are the penalties for early withdrawal from a certificate? · Terms of 12 months or less are assessed a day dividends penalty. · Terms greater than There is no monthly fee for CDs. Can I take money out of a CD early? Depending on your CD, you may be able to withdraw funds early without paying a penalty. We assess an early withdrawal penalty if you withdraw funds from the principal balance prior to the maturity date. Certain exceptions may apply. If you are. For terms greater than one year, the penalty is days of simple interest. For CDs opened on or before May 31, If the bank approves an early withdrawal. There are no penalties to withdraw when the CD has posted interest, is within the 10 day grace period, or due to the owner's death. Routing Number: For a CD with a Term of 60 Months or more: If you withdraw all of your principal balance or if the account is closed for any other reason before maturity, the. A flat fee: Some banks have a minimum penalty amount (e.g., $25) if you withdraw early. An interest amount even if the interest hasn't yet been earned: This. Early withdrawal penalty: If you redeem a Certificate of Deposit (CD) prior to maturity, you will incur an early withdrawal penalty. For a CD with a twelve. I cashed my certificate of deposit (CD) before it matured, and the bank charged me an early withdrawal penalty. Can it do this? Yes. While there are some. Q: What are the penalties for early withdrawal from a certificate? · Terms of 12 months or less are assessed a day dividends penalty. · Terms greater than There is no monthly fee for CDs. Can I take money out of a CD early? Depending on your CD, you may be able to withdraw funds early without paying a penalty. We assess an early withdrawal penalty if you withdraw funds from the principal balance prior to the maturity date. Certain exceptions may apply. If you are. For terms greater than one year, the penalty is days of simple interest. For CDs opened on or before May 31, If the bank approves an early withdrawal. There are no penalties to withdraw when the CD has posted interest, is within the 10 day grace period, or due to the owner's death. Routing Number: For a CD with a Term of 60 Months or more: If you withdraw all of your principal balance or if the account is closed for any other reason before maturity, the.

If you want to withdraw your money earlier, you will be subject to the following penalties: For CDs with terms of less than 90 days: all interest earned on. You may be asking yourself if it's better to withdraw the money from the CD (break the CD) and deposit that into a new CD at a higher interest rate when there. If you withdraw funds from a Certificate of Deposit (CD) or other deferred interest accounts before maturity, you may incur a penalty by the financial. Early Withdrawal Penalty: A penalty will be charged if you withdraw the principal before the maturity date. The penalty for early withdrawal from this. A penalty may be imposed for early withdrawal from a Certificate of Deposit. Penalties are assessed based on the term of the CD. Apr 16, •Knowledge ; The penalty for Certificates with terms less than one year is equal to ninety (90) days of dividends on the amount withdrawn, whether earned or not. The amount of the early withdrawal penalty is based on the term of your account. The penalty schedule is as follows: CD Terms of 3 months or less = 1 month's. These fees include early withdrawal penalties on time deposits and overdraft fees on checking accounts. You should contact your bank directly to confirm. We assess an early withdrawal penalty if you withdraw funds from the principal balance prior to the maturity date. Certain exceptions may apply. If you are. Q: What are the penalties for early withdrawal from a certificate? · Terms of 12 months or less are assessed a day dividends penalty. · Terms greater than Say you want to close a 3-year CD with a % interest rate and an early withdrawal penalty of four months' interest. You want to withdraw the entire $, These fees include early withdrawal penalties on time deposits and overdraft fees on checking accounts. You should contact your bank directly to confirm. I've been asked to research what compliance issues there might be with changing our CD early withdrawal penalties from interest based (e.g., 3 months interest). The amount of the early withdrawal penalty is based on the term of your account. The penalty schedule is as follows: CD Terms of 3 months or less = 1 month's. It's days early withdraw penalty. It's only been 4 months. Therefore they want 2 months of interest out of the principal. What are CD early withdrawal penalties? CD early withdrawal penalties are fees or financial penalties imposed by the bank or credit union when you withdraw. If a withdrawal of principal of your certificate account is made prior to the maturity date of the certificate, the early withdrawal penalty will be equal. $0 Early withdrawal penalty. · Earn a competitive fixed rate. · Ability to withdraw your full balance beginning 7 days after funding. · $ minimum balance. Over 24 months, the penalty is 12 months' interest. 4. The minimum opening deposit for a Standard Fixed Rate CD is $2,, unless otherwise noted. If a withdrawal of principal of your certificate account is made prior to the maturity date of the certificate, the early withdrawal penalty will be equal.

Top Ten Checking Accounts

Best Checking Account Interface. I'm interested in feedback on checking accounts from banks where you think the online experience is great. For Good Feels Good. · Interest bearing · First five ATM fees refunded (each month) · $25 minimum balance to open · No monthly service fee when you meet one of the. Morgan Stanley Private Bank Checking & Max-Rate Checking · Bank5 Connect High-Interest Checking account · Heritage Bank eCentive checking account · NBKC Bank. With three accounts to choose from, there's a perfect fit for you. Great checking and $? We think you deserve it. This is a limited-time promotion that. Student Checking. A great way to start banking, with no overdraft fees, or minimum balances. Pay for purchases using your debit card or mobile wallet. We offer four great checking account options to fit your lifestyle. And if you live in New England you can open a checking account online any time of the day. We believe the best checking accounts offer low or no fees, cash back, high APYs, and budgeting tools. Check out our best banks for checking accounts and. You can lock your card if it is activated and in good status. Locking blocks cash advances, ATM withdrawals, and purchases at point of sale, online, or over the. Best Checking Accounts – September ; Quontic High Interest Checking · · % ; Axos Bank Rewards Checking · · % ; Discover Cashback Debit · · %. Best Checking Account Interface. I'm interested in feedback on checking accounts from banks where you think the online experience is great. For Good Feels Good. · Interest bearing · First five ATM fees refunded (each month) · $25 minimum balance to open · No monthly service fee when you meet one of the. Morgan Stanley Private Bank Checking & Max-Rate Checking · Bank5 Connect High-Interest Checking account · Heritage Bank eCentive checking account · NBKC Bank. With three accounts to choose from, there's a perfect fit for you. Great checking and $? We think you deserve it. This is a limited-time promotion that. Student Checking. A great way to start banking, with no overdraft fees, or minimum balances. Pay for purchases using your debit card or mobile wallet. We offer four great checking account options to fit your lifestyle. And if you live in New England you can open a checking account online any time of the day. We believe the best checking accounts offer low or no fees, cash back, high APYs, and budgeting tools. Check out our best banks for checking accounts and. You can lock your card if it is activated and in good status. Locking blocks cash advances, ATM withdrawals, and purchases at point of sale, online, or over the. Best Checking Accounts – September ; Quontic High Interest Checking · · % ; Axos Bank Rewards Checking · · % ; Discover Cashback Debit · · %.

All Timberland Personal Checking Accounts include these great benefits: Free Online Banking; Free Mobile Banking and Mobile Check Deposit; Online Bill Pay. Checking Accounts. Checking Account Banner. Choose from Four Great Checking Options. ALMA Bank offers a range of checking accounts designed to match the way. Best overall checking accounts: Axos Bank® Rewards Checking · Best checking accounts for couples: SoFi Checking and Savings · Best free checking accounts: Quontic. Unity One Credit Union has three great checking account options for people in Fort Worth, Kansas City and St. Paul. Our top three picks for the best checking accounts are from Discover Bank, SoFi Bank and Ally Bank, all of which offer no monthly fees and access to large. account that rewards you, Southland has four great checking account options to choose from. FEATURED. Enjoy! Rewards Checking. Experience a little joy each. Best Checking Accounts ; Best Checking Accounts Overall. Primis Novus Checking. Our Good Checking (Free Checking Account) includes: Early Paycheck Access with Direct Deposit*; Debit Card; Online Banking with Bill Pay; Access to over. Online banking, mobile banking, Renasant Card App, mobile check deposit, and Zelle.©. Great Interest on Your Checking Balance. Earn a great checking rate. For. Best High-Yield Checking Accounts · La Capitol Federal Credit Union – % APY · Pelican State Credit Union – % APY · Credit Union of New Jersey – % APY. Check out the Consumers Credit Union Free Rewards Checking Account. The interest is solid and the rewards are pretty sweet — no monthly maintenance fees, good. We're excited to offer For Good Checking, an account unlike any other. Make a positive impact in your local community and enjoy a few extra perks. A great value in checking accounts, our Free Checking Account offers the following features: No monthly service fee; No minimum balance requirement (must. Personal checking accounts are great for a lot of different reasons—and those reasons are even more pronounced at Peoples Bank of Alabama. Capital One is great. No fees on their accounts, checking account has a % APY and they have a HYSA currently at %. They have a variety. Alliant Credit Union · Ally Bank · Axos Bank · Bank of America · Bank5Connect · Barclays · Bethpage Federal Credit Union · Bread Financial. A good checking account also costs nothing, meaning there should not be any monthly maintenance or balance fees, as well as no overdraft fees if your checks are. Budget Checking helps you carefully manage your money and avoid costly overdraft fees, making it a great option if you're on a budget or have a history of. Must be an active mobile banking user. Must be a customer for a minimum of two business days. Accounts must be in good standing. 7Monthly maintenance.

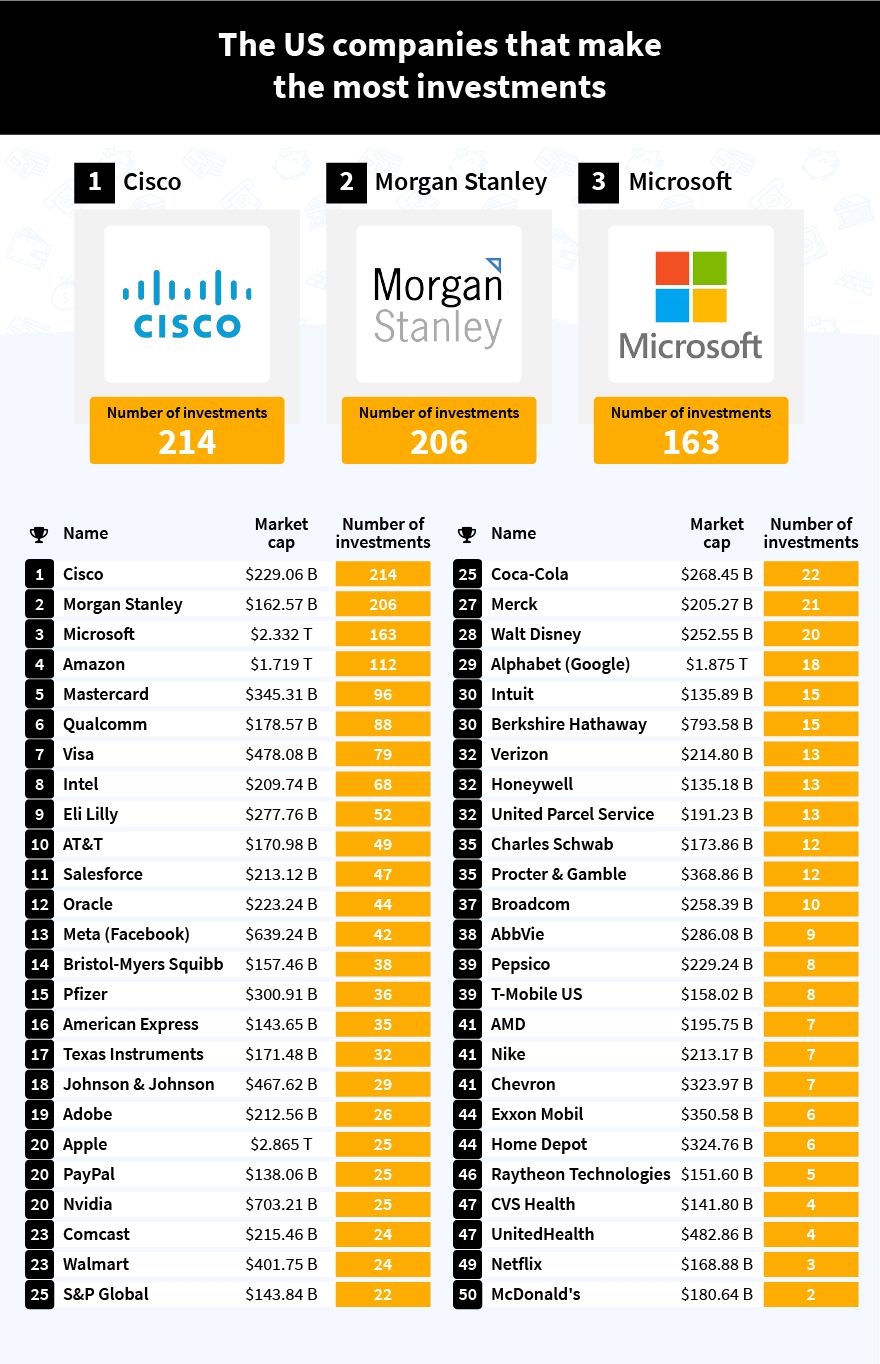

Top Investment Companies In America

1. Pillar Wealth Management 2. JPMorgan 3. Vanguard 4. Charles Schwab 5. BlackRock 6. Fidelity 7. Edward Jones 8. TIAA 9. Wealthfront TD Ameritrade. top investment companies by managed assets broken down for European equities, US Equities, other equities, European fixed-income securities. Largest companies ; 1. United States · BlackRock, United States, 9, ; 2. United States · Vanguard Group, United States, 7, KKR is a leading global investment firm offering solutions in alternative assets spanning real estate, private credit, private equity, and infrastructure. 1. BlackRock · 2. Vanguard Group · 3. State Street Global Advisors · 4. J.P. Morgan Asset Management · 5. Fidelity Investments. Overview: Best investments in · 1. High-yield savings accounts · 2. Long-term certificates of deposit · 3. Long-term corporate bond funds · 4. Dividend stock. Discover, find, & hire from the official Top 50 listing by 50Pros of the highest-ranking Investment Management agencies & firms that our experts vetted. Bank of America Corp. BofA is one of the world's largest and most highly respected financial institutions. It's also one of the world's most socially-. Barron's annual ranking of the top financial planning advisors. The ranking reflects the volume of assets overseen, revenues generated for the. 1. Pillar Wealth Management 2. JPMorgan 3. Vanguard 4. Charles Schwab 5. BlackRock 6. Fidelity 7. Edward Jones 8. TIAA 9. Wealthfront TD Ameritrade. top investment companies by managed assets broken down for European equities, US Equities, other equities, European fixed-income securities. Largest companies ; 1. United States · BlackRock, United States, 9, ; 2. United States · Vanguard Group, United States, 7, KKR is a leading global investment firm offering solutions in alternative assets spanning real estate, private credit, private equity, and infrastructure. 1. BlackRock · 2. Vanguard Group · 3. State Street Global Advisors · 4. J.P. Morgan Asset Management · 5. Fidelity Investments. Overview: Best investments in · 1. High-yield savings accounts · 2. Long-term certificates of deposit · 3. Long-term corporate bond funds · 4. Dividend stock. Discover, find, & hire from the official Top 50 listing by 50Pros of the highest-ranking Investment Management agencies & firms that our experts vetted. Bank of America Corp. BofA is one of the world's largest and most highly respected financial institutions. It's also one of the world's most socially-. Barron's annual ranking of the top financial planning advisors. The ranking reflects the volume of assets overseen, revenues generated for the.

CityWire RIA 50 Growers Across America · USA Today's Best Financial Advisory Firms · InvestmentNews Top 10 RIA logo · CityWire RIA 50 Growers Across. Explore CPPIB, a global investment management organization. Learn about our funds entrusted to us in the best interest of Canadian contributors and. Top 10 financial firms ranked by investors According to J.D. Power, Edward Jones did particularly well in the investment adviser and investment performance. BlackRock is one of the world's preeminent asset management firms and a premier provider of investment management. Find out more information here. Insider Intelligence has put together a list of the top investors and wealth management companies — Betterment, Vanguard, Moneyfarm, Robinhood, Advizr, Nutmeg. USA Today's Best Financial Advisory Firms · InvestmentNews Top 10 RIA The IPC has over combined years of industry experience. Top-Down, Global. With $ billion of assets under management, Carlyle's purpose is to invest wisely and create value on behalf of our investors, portfolio companies. The top investment & wealth management companies to pay attention to in · Powerful data and analysis on nearly every digital topic · Want more. research? Trends in Mutual Fund Investing. The combined assets of the nation's mutual funds increased by $ billion, or percent, to $ trillion in June. Oversees investment advisers and investment companies, including mutual funds and other investment Return to top. SEC homepage U.S. Securities and. Get access to Lusha's database of business leads from investment management companies in United states. companies are listed in our database. Top 25 Mutual Funds ; 16, VTBIX · Vanguard Total Bond Market II Index Fund;Investor ; 17, AGTHX · American Funds Growth Fund of America;A ; 18, FCNTX · Fidelity. Investment Management Companies ; BlackRock · · 24, ; State Street Global Advisors · · ; Allianz Life · · 4, ; Investors Management Corporation. Launched in , Merrill Edge is an online trading platform, which merged Bank of America Online Investing with Merrill Lynch's research, investment tools, and. PIMCO Investments LLC (“PIMCO Investments”) is a broker-dealer registered with the SEC and member of the Financial Industry Regulatory Authority, Inc. (“FINRA”). Fidelity, Schwab and Vanguard have specific qualities that appeal to investors, which I'll discuss shortly. But they're the best overall because they charge. investment products sponsored, managed, distributed or provided by companies that are affiliates of Bank of America Corporation (“BofA Corp.”). MLPF&S is a. 1. Fidelity With over 40 million customers, it's no wonder Fidelity is often rated as the best overall investment firm and often cited for its low fees. Mutual Funds · American Century Investments · American Funds · Invesco · Fidelity Advisor Funds · Franklin Templeton Investments · MFS Investment Management · Nuveen. Investcorp is a global investment manager, specializing in alternative investments across private equity, real estate, credit, absolute return strategies.

What Is Capital One Quicksilver Credit Card

See the Capital One Quicksilver Cash Rewards Credit Card rates, fees, and bonuses on Credit Karma to decide if the Capital One Quicksilver Cash Rewards. The Capital One Quicksilver Cash Rewards Credit Card could be a great option for you, as it earns % cash back on every single purchase. The Capital One Quicksilver Cash Rewards Credit Card is a simple cash-back credit card that offers % Cash Back on every purchase, every day. Plus, new. The Capital One Quicksilver Cash Rewards Credit Card could be a great option for you, as it earns % cash back on every single purchase. The Quicksilver is a good credit card to build credit if you qualify and use the card responsibly. But because this card typically requires good or excellent. Find out all about the Capital One® QuicksilverOne® Cash Rewards Credit Card - we'll provide you with the latest information and tell you everything you. With an APR of 0% intro on purchases for 15 months, this card is also a great option for low interest. There is no annual fee, and the ongoing APR is % -. The Capital One Quicksilver Cash Rewards takes the guesswork out of earning cash-back rewards by offering an unlimited % earning rate across all purchases. The quicksilver is as good as you can find for a catch-all rewards card with no annual fee and no foreign transaction fees. Even using. See the Capital One Quicksilver Cash Rewards Credit Card rates, fees, and bonuses on Credit Karma to decide if the Capital One Quicksilver Cash Rewards. The Capital One Quicksilver Cash Rewards Credit Card could be a great option for you, as it earns % cash back on every single purchase. The Capital One Quicksilver Cash Rewards Credit Card is a simple cash-back credit card that offers % Cash Back on every purchase, every day. Plus, new. The Capital One Quicksilver Cash Rewards Credit Card could be a great option for you, as it earns % cash back on every single purchase. The Quicksilver is a good credit card to build credit if you qualify and use the card responsibly. But because this card typically requires good or excellent. Find out all about the Capital One® QuicksilverOne® Cash Rewards Credit Card - we'll provide you with the latest information and tell you everything you. With an APR of 0% intro on purchases for 15 months, this card is also a great option for low interest. There is no annual fee, and the ongoing APR is % -. The Capital One Quicksilver Cash Rewards takes the guesswork out of earning cash-back rewards by offering an unlimited % earning rate across all purchases. The quicksilver is as good as you can find for a catch-all rewards card with no annual fee and no foreign transaction fees. Even using.

Capital One QuicksilverOne Cash Rewards Credit Card · Earn unlimited % cash back on every purchase, every day · No rotating categories or limits to how much. Find out all about the Capital One® Quicksilver® Cash Rewards Credit Card - we'll provide you with the latest information and tell you everything you need. Why We Like It: The Capital One Quicksilver Cash Rewards Credit Card is a simple flat-rate cash back card ideal for people who don't want to keep track of. The Capital One QuicksilverOne card offers % cash back and is designed for those with fair, average or limited credit. Get the details. Earn unlimited % cash back on every purchase, every day. Annual Fee $ Purchase Rate % variable APR. Is there a limit to the amount of cash back rewards I can earn with my Capital One card? · The Quicksilver card suite offers unlimited rewards for all of your. Capital One Quicksilver Cash Rewards Credit Card gives you % cash back on every purchase, every day, with no limit. Unlike some competing cards, there are no. Quicksilver Rewards for Students. Earn unlimited % cash back on every purchase, every day. $0 annual fee. Plus, earn a $50 cash bonus. No, the Capital One Quicksilver® Cash Rewards Credit Card does not charge any foreign transaction fees, making it a great option for international travel. . Is. Capital One Quicksilver cash rewards credit card offers a 15 month 0% introductory interest rate on purchases. There are no annual fees or foreign transaction. Quicksilver Secured from Capital One. Earn % cash back on every purchase with a refundable $ minimum deposit. Find out if you're pre-approved. Capital One Quicksilver Cash Rewards Credit Card is a. That means you can use your Capital One Quicksilver card at millions of merchant locations in more. The Capital One Quicksilver is a very good everyday rewards card for people with good credit. Thanks to benefits that include a $0 annual fee, an intro APR, and. The Quicksilver Secured credit card offers 5% cash back on hotels and rental cars booked through Capital One Travel and a flat % cash back on every purchase. Got questions about Capital One Quicksilver Cash Rewards Credit Card? 10xTravel's simple, thorough review helps clear the fog and maximize the benefits. Get the Capital One Quicksilver Cash Rewards Credit Card and start earning cash back on every purchase. Apply securely online today! | CompareCredit. What is a Capital One Quicksilver is a Cash Rewards Credit Card? The Capital One Quicksilver Cash Rewards Credit Card that offers a flat % cash back rate on. The Capital One Quicksilver Cash Rewards Credit Card is the best. By owning this card, you get % cash back on everything you purchase. Capital One Quicksilver Cash Rewards for Good Credit · Earn unlimited % cash back on every purchase, every day · $0 annual fee and no foreign transaction fees. You will pay a $39 annual fee but receive benefits, including $0 fraud liability, tap-to-pay technology and free credit monitoring with CreditWise from Capital.

Car Insurance First Month Free No Deposit

Progressive; State Farm; Allstate; Safe Auto; Kemper; eInsurance. How to Qualify for Car Insurance with Nothing Down? Various insurance companies use. car insurance: The key to cheap no-deposit insurance? The best car insurance companies for low deposit auto insurance; Avoid “first month free” scams; Learn. Some of the cheapest car insurance companies with low upfront costs include Allstate, Progressive, and Nationwide. Pay-as-you-go car insurance. Only pay for days that you drive. Nothing more. Secure an arrangement with a positive auto month to month premium installment with no deposit plan which is less demanding to oversee and maintain. We can help. Many people mistakenly think they will get first month free car insurance with this type of plan. No insurance company offers free auto insurance for a week. Looking for instant car insurance with no deposit? FreeCarInsuranceQuote offer car insurance with no upfront deposit. Get a quote today and start driving. There is just no such thing as free car insurance, as you must make a payment before your policy goes into effect. No insurance company will cover a motorist. They all offer zero down payment car insurance online. You can buy your $0 down policy in just a few minutes of your time; you can be covered with a first-month. Progressive; State Farm; Allstate; Safe Auto; Kemper; eInsurance. How to Qualify for Car Insurance with Nothing Down? Various insurance companies use. car insurance: The key to cheap no-deposit insurance? The best car insurance companies for low deposit auto insurance; Avoid “first month free” scams; Learn. Some of the cheapest car insurance companies with low upfront costs include Allstate, Progressive, and Nationwide. Pay-as-you-go car insurance. Only pay for days that you drive. Nothing more. Secure an arrangement with a positive auto month to month premium installment with no deposit plan which is less demanding to oversee and maintain. We can help. Many people mistakenly think they will get first month free car insurance with this type of plan. No insurance company offers free auto insurance for a week. Looking for instant car insurance with no deposit? FreeCarInsuranceQuote offer car insurance with no upfront deposit. Get a quote today and start driving. There is just no such thing as free car insurance, as you must make a payment before your policy goes into effect. No insurance company will cover a motorist. They all offer zero down payment car insurance online. You can buy your $0 down policy in just a few minutes of your time; you can be covered with a first-month.

Down Payment Auto Insurance provides free car insurance to first-time drivers with no money down. There is a Down Payment required, typically. Down Payment Auto Insurance provides free car insurance to first-time drivers with no money down. There is a Down Payment required, typically. Get No Down Payment Car Insurance Online & Save $s. Fast, Free Quotes. Cheapest $0 Down Car Insurance Rates from Just $19 a month. CHOOSE YOUR DEPOSIT. or pay no deposit at all, depending on your circumstances. SELECT YOUR CAR LOAN TERM. between two and. Companies offering cheap car insurance with no down payment usually count the new policyholder's first premium payment as a deposit. short term car insurance for up to 28 days. Fully comprehensive cover without being tied into an annual contract. Insure your car or borrow someone else's. Technically, there is no such thing as 'no deposit' car insurance. However, it is a term often used by insurers to promote their pay monthly car insurance plans. Be suspicious of any company who offers you the first month of your car insurance plan for free. Auto insurance companies do not provide coverage before you. The fines and suspension periods increase if you continue to get caught driving without auto insurance. First offense: A fine of $ and a three-month driver's. Car Insurance First Month Free No Deposit is an attractive option for drivers. This special offer allows vehicle owners to get insured without having to pay any. Companies that advertise car insurance with no down payment, no deposit, or the first month free are likely not reputable and should be avoided. Understand. Likely not going to find anyone who is going to give you coverage with no money down. State Farm will allow you to pay only the first month's. Many people mistakenly think they will get first month free car insurance with this type of plan. No insurance company offers free auto insurance for a week. If you purchase a no deposit insurance policy, you will have to pay the first month's cover immediately. However, you do not have to pay an upfront deposit. They'll be in a position to let you know as to whether or not they're going to be capable of getting you a no deposit car insurance package. Truth be told, most. Again, no insurer offers free car insurance for a month, and there is no such thing. For a car insurance policy to become active, you must first make a payment. No deposit car insurance is a way some insurance companies advertise their cover to make it seem like you don't have to pay any money upfront. What insurers often mean by stating “no deposit required” or “zero down payment” is they'll waive the down payment or deposit, but your policy still won't go. They'll be in a position to let you know as to whether or not they're going to be capable of getting you a no deposit car insurance package. Truth be told, most. While it's not possible to get car insurance without making a first-month payment, some insuranc So you want free auto insurance and full.

Can You Buy Stock In Google

Join the millions of people using the v-g.site app every day to stay on top of the stock market and global financial markets! Navigate to the Explore page. Then, type Alphabet into the search bar. When you see Alphabet stock appear in the results, tap it to open up the purchase screen. Navigate to the Explore page. Then, type Alphabet into the search bar. When you see Alphabet stock appear in the results, tap it to open up the purchase screen. To buy GOOGL shares in Australia, you'll need to open an account with an investing platform that offers the security. Try Stake, you can sign up in minutes. With Google Nest or Home speaker or display, you can get information on your individual stocks and portfolio, as well as stay on top of the global market. Find the latest Alphabet Inc. (GOOG) stock quote, history, news and other vital information to help you with your stock trading and investing. You can buy Google stock from any reputable online stock brokerage. Just open an account, fund it, log into the broker's platform, and place your order. Should. Buy Google Stock Using Trading Platform: After opening account you can trade Google shares CFDs by using MetaTrader or NetTradeX trading platforms. Alphabet. Click Add investments. Enter the stock, mutual fund, or cryptocurrency you want to add, and select the correct option that appears as you type. Enter the. Join the millions of people using the v-g.site app every day to stay on top of the stock market and global financial markets! Navigate to the Explore page. Then, type Alphabet into the search bar. When you see Alphabet stock appear in the results, tap it to open up the purchase screen. Navigate to the Explore page. Then, type Alphabet into the search bar. When you see Alphabet stock appear in the results, tap it to open up the purchase screen. To buy GOOGL shares in Australia, you'll need to open an account with an investing platform that offers the security. Try Stake, you can sign up in minutes. With Google Nest or Home speaker or display, you can get information on your individual stocks and portfolio, as well as stay on top of the global market. Find the latest Alphabet Inc. (GOOG) stock quote, history, news and other vital information to help you with your stock trading and investing. You can buy Google stock from any reputable online stock brokerage. Just open an account, fund it, log into the broker's platform, and place your order. Should. Buy Google Stock Using Trading Platform: After opening account you can trade Google shares CFDs by using MetaTrader or NetTradeX trading platforms. Alphabet. Click Add investments. Enter the stock, mutual fund, or cryptocurrency you want to add, and select the correct option that appears as you type. Enter the.

As soon as the layman understands just how much of a game changer quantum computing will be, I think the hype will make the stock jump. Find the latest Alphabet Inc. (GOOG) stock quote, history, news and other vital information to help you with your stock trading and investing. P/E (price-to-earnings) analysis: Google is currently at $, with a P/E of That means it will take 63 years for Google to earn back the price of the share. View the real-time GOOGL price chart on Robinhood and decide if you want to buy or sell commission-free. Other fees such as trading (non-commission) fees. The main difference between the GOOG and GOOGL stock ticker symbols is that GOOG shares have no voting rights, while GOOGL shares do. Google went public through an initial public offering (IPO) in , issuing shares of Class A common stock on the Nasdaq Global Select Market under the symbol. Yes, great question most people are wondering. You open the phantom app and sign in. Then minimize it. Then open the robinhood app, and buy Google stock there. shares spike on earnings beat, unveils Google partnership. Profile. MORE We want to hear from you. Get In Touch. CNBC Newsletters. Sign up for free. Google Finance provides real-time market quotes, international exchanges, up-to-date financial news, and analytics to help you make more informed trading. shares spike on earnings beat, unveils Google partnership. Profile. MORE We want to hear from you. Get In Touch. CNBC Newsletters. Sign up for free. Google (or Alphabet as that's the parent company) would % be notified. As well, you more than likely would not buy all these shares on. Is Alphabet Inc. stock A Buy? Google holds several negative signals and is within a wide and falling trend, so we believe it will still perform weakly in the. Yes, you can purchase fractional shares of Alphabet Inc (Class A) Google Shares (GOOGL) or any other US company shares in Angel One for any dollar amount. What. You can use the bid-ask spread to determine whether to place a market order or limit order when trading, helping you to optimize your price and have a. Google Finance provides real-time market quotes, international exchanges, up-to-date financial news, and analytics to help you make more informed trading. One way to bet on GOOG or GOOGL shares is to instead use options contracts, which often trade at a fraction of the price of the actual shares. Google Option. Shop Google stock certificates today! Offering the lowest price guarantee on one share stocks of Google. Shop now! This is because the market assigns a value to the voting power that an investor will receive if they buy class A stock. The premium is usually between 1% Take advantage of our comprehensive research and low online commission rates to buy and sell shares of publicly traded companies in both domestic and. If you want to start buying individual stocks and make your money work for you, Google Finance is a great place to conduct thorough research and learn more.

If I Lose My Job What Happens To My 401k

Workers 55 and older can access (k) funds without penalty if they part ways with their employer, whether they're laid off, fired, or quit. · Unemployed. When you leave your job, your employer can choose to hold or disburse your (k) money depending on your age and the amount of retirement savings you have. When you quit a job, your (k) stays where it is until you decide what to do with it. You can roll it over into your new (k), roll it into an IRA. At a Glance · A (k) is a retirement account with tax benefits. · Options when leaving a job: leave it, withdraw (with penalties and taxes), or roll it over . When you quit a job, your (k) stays where it is until you decide what to do with it. You can roll it over into your new (k), roll it into an IRA. Can I cash in all or part of my (k) if I need additional emergency funds? Yes. You have the option of cashing in your retirement plan, but you should. Unless any of it was post-tax dollars like a ROTH k, it will all be taxable and subject to 10% penalty. This is in most cases a terrible idea. Should I roll over my (k) or leave it in my previous employer's plan? · (k) rollover option 1: Keep your savings with your previous employer's plan · (k). Once you leave a job where you have a (k), you can no longer make contributions to the plan and no longer receive the match. Workers 55 and older can access (k) funds without penalty if they part ways with their employer, whether they're laid off, fired, or quit. · Unemployed. When you leave your job, your employer can choose to hold or disburse your (k) money depending on your age and the amount of retirement savings you have. When you quit a job, your (k) stays where it is until you decide what to do with it. You can roll it over into your new (k), roll it into an IRA. At a Glance · A (k) is a retirement account with tax benefits. · Options when leaving a job: leave it, withdraw (with penalties and taxes), or roll it over . When you quit a job, your (k) stays where it is until you decide what to do with it. You can roll it over into your new (k), roll it into an IRA. Can I cash in all or part of my (k) if I need additional emergency funds? Yes. You have the option of cashing in your retirement plan, but you should. Unless any of it was post-tax dollars like a ROTH k, it will all be taxable and subject to 10% penalty. This is in most cases a terrible idea. Should I roll over my (k) or leave it in my previous employer's plan? · (k) rollover option 1: Keep your savings with your previous employer's plan · (k). Once you leave a job where you have a (k), you can no longer make contributions to the plan and no longer receive the match.

Employees will invest the funds in a (k) account in several investment options, depending on what the employer and their (k) administrator offer, such as. If you have been laid off unexpectedly, you may consider tapping into your (k) to pay your expenses. Here are the various ways to access your (k). If your (k) or (b) balance has less than $1, vested in it when you leave, your former employer can cash out your account or roll it into an individual. Don't cash out your retirement savings upon losing your job. Instead, roll it over into an IRA or a new employer's retirement savings plan to continue. Do I get my k if I get fired? The good news: your (k) money is yours, and you can take it with you when you leave your employer, whether that means. Unless any of it was post-tax dollars like a ROTH k, it will all be taxable and subject to 10% penalty. This is in most cases a terrible idea. What You Can Do with a (k) Balance When You Leave · Leave the money where it is (assuming you meet the minimum required balance, typically $) · Roll the. Roll over your (k) account. · Make a direct transfer of your entire account balance to a Rollover IRA. This way your money continues to grow tax-free. · Get a. One of the hardest parts of retirement planning is getting started. If you opened and saved through a (k) plan at a former employer, you should pat. An employer-sponsored retirement plan may offer choices for what to do with your account balance in the plan when you decide to change jobs or retire. You have access to the employer-matched funds in your (k) after leaving a job only if you are fully vested. If not fully vested, you may forfeit some or all. The Tax Reform law extended the repayment period for your (k) loan until the due date of your tax return, including extensions. If you don't repay the. 2 Roll your (k) to your new employer—If your new employer allows it, you might consider rolling your money into their (k) plan to have all your retirement. Generally, you may be able to leave your savings in your existing plan if your account balance is more than $5, losing money when you invest in securities. When you lose your job, the only time you face a penalty on your (k) is when you have taken out a loan against it. Typically, if you have an outstanding K loan and leave or are terminated from your job, there is a short period of time in which you are. If your balance is over $ but less than their threshold for allowing the money to stay in the plan (usually $), your old employer must give you at least. Just because you're leaving your job doesn't mean you have to also walk away from your employer's retirement plan. There may be some advantages to leaving money. You can cash out your entire retirement plan balance when you leave an employer. But that could have a major impact on your savings—and your retirement. The pros: If your former employer allows it, you can leave your money where it is. Your savings have the potential for growth that is tax-deferred, you'll pay.

Best Web Hosting For Individuals

Best web hosting services · DreamHost: Best for bloggers. · Mochahost: Best value. · Namecheap: Best introductory plans. · InMotion: Best email offerings. · A2. Whether you're a website beginner or an expert, find the best web hosting plan for your needs with v-g.site Our hosting plans offer the flexibility to choose. Best “Free” Web Hosting Sites Reviewed · 1. Wix · 2. Webhost · 3. x10Hosting · 4. Weebly · 5. Freehostia. BlueHost is among the most popular web hosting services used by thousands of beginners and experienced webmasters worldwide. It is also among the few web. Based on our research, Bluehost is the number one recommended web hosting provider! It offers a great blend of features, help and support, and value for. Like some other web hosts, InMotion Hosting lets you grow with their service. You can move from a shared hosting account to higher-end VPS, cloud, and dedicated. Unlock Your Website's Full Potential with Bluehost. Trusted by Millions of Websites Worldwide. Affordable Plans, Reliable Hosting, Easy WordPress Website. DreamHost is an affordable, robust web host. Shared hosting, VPS, Cloud and Dedicated hosting are all available, each with their own respective plans, making. I would suggest godady for your hosting need because it provides both windows and linux servers at affordable price. aducom. Best web hosting services · DreamHost: Best for bloggers. · Mochahost: Best value. · Namecheap: Best introductory plans. · InMotion: Best email offerings. · A2. Whether you're a website beginner or an expert, find the best web hosting plan for your needs with v-g.site Our hosting plans offer the flexibility to choose. Best “Free” Web Hosting Sites Reviewed · 1. Wix · 2. Webhost · 3. x10Hosting · 4. Weebly · 5. Freehostia. BlueHost is among the most popular web hosting services used by thousands of beginners and experienced webmasters worldwide. It is also among the few web. Based on our research, Bluehost is the number one recommended web hosting provider! It offers a great blend of features, help and support, and value for. Like some other web hosts, InMotion Hosting lets you grow with their service. You can move from a shared hosting account to higher-end VPS, cloud, and dedicated. Unlock Your Website's Full Potential with Bluehost. Trusted by Millions of Websites Worldwide. Affordable Plans, Reliable Hosting, Easy WordPress Website. DreamHost is an affordable, robust web host. Shared hosting, VPS, Cloud and Dedicated hosting are all available, each with their own respective plans, making. I would suggest godady for your hosting need because it provides both windows and linux servers at affordable price. aducom.

Unlock Your Website's Full Potential with Bluehost. Trusted by Millions of Websites Worldwide. Affordable Plans, Reliable Hosting, Easy WordPress Website. We scoured the market to find the top 10 hosting brands. Our research examines factors such as product and pricing options, essential features, and important. SiteGround is a web hosting provider that offers seamless integration with open-source website builders like WordPress, WooCommerce and more. It's known for its. Top 17 Web Hosting Companies in the US · 1. GoDaddy · 2. Namecheap, Inc · 3. Liquid Web · 4. DreamHost · 5. 1&1 Internet, Inc. · 6. InMotion Hosting · 7. We've dedicated great time and resources towards assessing the performance of a broad array of hosting providers, from giants like SiteGround, Hostinger, and. 8 Best Web Hosting Services of ; Best Affordable Option. We love to recommend website builders because these platforms handle hosting for you and we know it can be hard work to pick the best web host for your website. Best Web Hosting Providers: Top 5 Services Reviewed · #1. Bluehost · Bluehost Gallery · #2. Hostinger · Hostinger Gallery · #3. GoDaddy Hosting · GoDaddy Gallery · #4. The best web hosting providers · Bluehost · HostGator · GoDaddy · Hostinger · SiteGround · DreamHost · A2 Hosting · InMotion Hosting. Best Web Hosting Providers · Bluehost - best value for starters + officially recommended by WordPress · SiteGround best premium web hosting service at affordable. v-g.site · BlueHost · HostGator · GoDaddy · InMotion Hosting · Hostinger · Interserver · DreamHost. Web Hosting Canada offers Powerful Canadian Web Hosting Plans including Free Domain, Site Builder, Wordpress, Email & 24/7 support. Start now! WP Engine is a website hosting service built to host WordPress for companies of any size, with features such as daily backups, firewall,SSL, and proprietary. The Best Web Hosting of Best overall: Hostinger () We chose Hostinger as the best web hosting service for its excellent speed, support. For personal website, I'll recommend Pair Networks (v-g.site). They offers the best and reliable hosting services with one of the best 24/7 customer support. GoDaddy's Reliable Web Hosting keeps your website up and running. Featuring % uptime guarantee and award winning 24/7 tech support! Discover Namecheap, your top web hosting provider for affordable and reliable hosting. For beginners and professionals, we offer cheap hosting plans to fit. We've awarded Siteground the title of the best web hosting for security due to the range of features it includes with all it's hosting plans, out of the box. The best web hosting service for most people in is Hostinger. Getting your website up and running has never been easier.

W4 Versus W2

W If the employer withholds income tax, the employer must report the tax withheld in box 2 of Form W-2 and on line 8 of Form See Pub. 15 (Circular E). The W-2 boxes and W-2 codes show the taxable wages, you've earned and any taxes paid through withholding. Employers submit Form W-4 to the Internal Revenue. Income tax would have been withheld if the employee had claimed no more than one withholding allowance or had not claimed exemption from withholding on Form W Note: For tax years beginning on or after. January 1, , the personal exemption allowance, and additional allowances if you or your spouse are age 65 or. W2 employees get their name because of the W-2 form employers file with the IRS to employ them. This means they are full time employees paid, not for contract. W-2 Tax Summary Sheets W-2s are being processed and will be mailed out before January 31st. Duplicate W-2s will not be available until early February. Employers fill out a W-2 each year to report an employee's wages, while new employees fill out Form W-4 to highlight how much in taxes they want taken out. This article highlights everything you need to know about W-2 and W-4 forms, what they mean, when to use each one, and how to file them properly. The tax calculation is impacted by the classification of employees, affecting both the employer and the workers. Employers must withhold income taxes and pay. W If the employer withholds income tax, the employer must report the tax withheld in box 2 of Form W-2 and on line 8 of Form See Pub. 15 (Circular E). The W-2 boxes and W-2 codes show the taxable wages, you've earned and any taxes paid through withholding. Employers submit Form W-4 to the Internal Revenue. Income tax would have been withheld if the employee had claimed no more than one withholding allowance or had not claimed exemption from withholding on Form W Note: For tax years beginning on or after. January 1, , the personal exemption allowance, and additional allowances if you or your spouse are age 65 or. W2 employees get their name because of the W-2 form employers file with the IRS to employ them. This means they are full time employees paid, not for contract. W-2 Tax Summary Sheets W-2s are being processed and will be mailed out before January 31st. Duplicate W-2s will not be available until early February. Employers fill out a W-2 each year to report an employee's wages, while new employees fill out Form W-4 to highlight how much in taxes they want taken out. This article highlights everything you need to know about W-2 and W-4 forms, what they mean, when to use each one, and how to file them properly. The tax calculation is impacted by the classification of employees, affecting both the employer and the workers. Employers must withhold income taxes and pay.

W-4 is sent to the IRS or Social Security Administration · W-2's are given to employees and they send it to the Social Security Administration. This form details the amount of tax deductions employees will have in their income. The W-4 form bases the tax deduction amount on several variables such as. You will receive copies of your W-2 Wage and Tax Statement every year by January The worksheets with the W-4 federal and IT NYS certificates. A W-2 is crucial for filing accurate tax returns every year. A W-4 is a form that employees complete and submit to their employers when they begin a new job or. The IRS Forms W-2 and W-4 differ from each other based on who completes the paperwork and who fills them out. Employers withhold taxes from employees'. Federal Form W-2 is a wage and tax statement that reports employment income and withholding and may be needed for individuals to prepare their individual. The W-2 form is essentially a report of an employee's total earnings throughout the year. This includes bonuses and the total income tax withheld for important. However, there may be instances where a worker may be serving as an independent contractor and an employee for the same entity. Example. Joe is a custodian who. A W-4 informs employers how much tax they should withhold from each employee's wages. By contrast, a W-2 is where you report your employee's wages and taxes. The W-2 form reports an employee's annual wages and the amount of taxes withheld from his or her paycheck. Gross income is the amount of money that each employee makes prior to taxes and deductions. A W-2 includes this income information to show an employee's tax. A W-2 tax form reports an employee's earnings for the year and records the amount of federal, state, and other taxes withheld from employees' pay. Generally, you must withhold and deposit income taxes, social security taxes and Medicare taxes from the wages paid to an employee. Additionally, you must also. W-4 Forms are Filled by Employees · Employers are Responsible for Filling in Form W-2 · FAMILIARIZE YOUR REMITTANCES AND FILING OF IRS W-4 AND W-2 IS MUCH FASTER. Form W-2, also known as the Wage and Tax Statement, is a document an employer sends to each employee and the Internal Revenue Service (IRS) and shows income. We're breaking down these forms and sharing links to help ensure you encounter less surprises at tax time. No. The W4 form is filled out to instruct your employer how to calculate your federal (and possibly state) withholding. The W2 form is the. Small business owners need to report employee income to both the employee and the IRS with a W-2 as the end of the year. If you have independent contractors. The main purpose of form W-2 is for employers to state the total compensation paid and taxes withheld from an employee's earnings for the past tax year. – Purpose: The W2 form reports yearly earnings and taxes paid, necessary for filing your tax return. The W4 form dictates how much tax should be withheld from.

Saft Stock Price

The Saft Groupe SA stock price today is What Is the Stock Symbol for Saft Groupe SA? The stock ticker symbol for Saft Groupe SA is SGPEF. Is SGPEF the. Historical daily share price chart and data for Safety Insurance since adjusted for splits and dividends. The latest closing stock price for Safety. Safety Insurance Group Inc SAFT:NASDAQ · Open · Day High · Day Low · Prev Close · 52 Week High · 52 Week High Date08/29/24 · 52 Week. Safety Insurance Group Inc stock price (SAFT). Buying or selling a stock that's not traded in your local currency? Don't let the currency conversion trip. How much is Safety Insurance Group's stock price per share? (NASDAQ: SAFT) Safety Insurance Group stock price per share is $ today (as of Sep 6, ). Safety Insurance Group Inc (SAFT) stock price, GURU trades, performance, financial stability, valuations, and filing info from GuruFocus. Discover real-time Safety Insurance Group, Inc. Common Stock (SAFT) stock prices, quotes, historical data, news, and Insights for informed trading and. Safety Insurance Group Inc. analyst ratings, historical stock prices, earnings estimates & actuals. SAFT updated stock price target summary. SAFT is trading within a range we consider fairly valued. Price. $ The Saft Groupe SA stock price today is What Is the Stock Symbol for Saft Groupe SA? The stock ticker symbol for Saft Groupe SA is SGPEF. Is SGPEF the. Historical daily share price chart and data for Safety Insurance since adjusted for splits and dividends. The latest closing stock price for Safety. Safety Insurance Group Inc SAFT:NASDAQ · Open · Day High · Day Low · Prev Close · 52 Week High · 52 Week High Date08/29/24 · 52 Week. Safety Insurance Group Inc stock price (SAFT). Buying or selling a stock that's not traded in your local currency? Don't let the currency conversion trip. How much is Safety Insurance Group's stock price per share? (NASDAQ: SAFT) Safety Insurance Group stock price per share is $ today (as of Sep 6, ). Safety Insurance Group Inc (SAFT) stock price, GURU trades, performance, financial stability, valuations, and filing info from GuruFocus. Discover real-time Safety Insurance Group, Inc. Common Stock (SAFT) stock prices, quotes, historical data, news, and Insights for informed trading and. Safety Insurance Group Inc. analyst ratings, historical stock prices, earnings estimates & actuals. SAFT updated stock price target summary. SAFT is trading within a range we consider fairly valued. Price. $

Get Safety Insurance Group Inc (saft.o) real-time stock quotes, news, price and financial information from Reuters to inform your trading and investments. SAFT - Safety Insurance Group, Inc. - Stock screener for investors and traders, financial visualizations. Stock analysis for Safety Insurance Group Inc (SAFT:NASDAQ GS) including stock price, stock chart, company news, key statistics, fundamentals and company. Key Data in USD ; P/E ratio (year end quote, diluted EPS), , ; P/E ratio (year end quote), , ; Dividend yield in %, , ; Equity ratio. Real time Safety Insurance Group (SAFT) stock price quote, stock graph, news & analysis. This dedication to giving investors a trading advantage led to the creation of our proven Zacks Rank stock-rating system. Since it has more than doubled. The Saft Groupe SA stock price today is What Is the Stock Symbol for Saft Groupe SA? The stock ticker symbol for Saft Groupe SA is SGPEF. Is SGPEF the. Fundamentals · Price/Earnings ttm · Earnings Per Share ttm · Most Recent Earnings $ on 05/08/24 · Next Earnings Date 08/07/24 [--] · Annual. Participation from Market Makers and ECNs is strictly voluntary and as a result, these sessions may offer less liquidity and inferior prices. Stock prices may. Safety Insurance Group, Inc. (v-g.site): Stock quote, stock chart, quotes, analysis, advice, financials and news for Stock Safety Insurance Group. As a leading battery company, Saft's innovative, safe, and reliable technology delivers high performance on land, at sea, in the air, and in space. View Safety Insurance Group, Inc. SAFT stock quote prices, financial information, real-time forecasts, and company news from CNN. Safety | SAFTStock Price | Live Quote | Historical Chart ; CIG Pannónia Életbiztosító, , , % ; Progressive, , , %. Safety Insurance Group, Inc. (NASDAQ:SAFT) today approved a $ per share quarterly cash dividend on its issued and outstanding common stock. Check if SAFT Stock has a Buy or Sell Evaluation. SAFT Stock Price (NASDAQ), Forecast, Predictions, Stock Analysis and Safety Insurance Group News. Last Price. US$ ; Market Cap. US$b ; 7D. % ; 1Y. % ; Updated. 04 Sep, Stock price history for Safety Insurance (SAFT). Highest end of day price: $ USD on Lowest end of day price: $ USD on Stock. Get Safety Insurance Group Inc (SAFT.C) real-time stock quotes, news, price and financial information from Reuters to inform your trading and investments. In depth view into SAFT (Safety Insurance Group) stock including the latest price, news, dividend history, earnings information and financials. Get a real-time Safety Insurance Group, Inc. (SAFT) stock price quote with breaking news, financials, statistics, charts and more.